Summary

We study the optimal liquidation problem in a market model where the bid price follows a geometric pure jump process whose local characteristics are driven by an unobservable finite-state Markov chain and by the liquidation rate. This model is consistent with stylized facts of high frequency data such as the discrete nature of tick data and the clustering in the order flow. We include both temporary and permanent effects into our analysis. We use stochastic filtering to reduce the optimal liquidation problem to an equivalent optimization problem under complete information. This leads to a stochastic control problem for piecewise deterministic Markov processes (PDMPs). We carry out a detailed mathematical analysis of this problem. In particular, we derive the optimality equation for the value function, we characterize the value function as continuous viscosity solution of the associated dynamic programming equation, and we prove a novel comparison result. The paper concludes with numerical results illustrating the impact of partial information and price impact on the value function and on the optimal liquidation rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

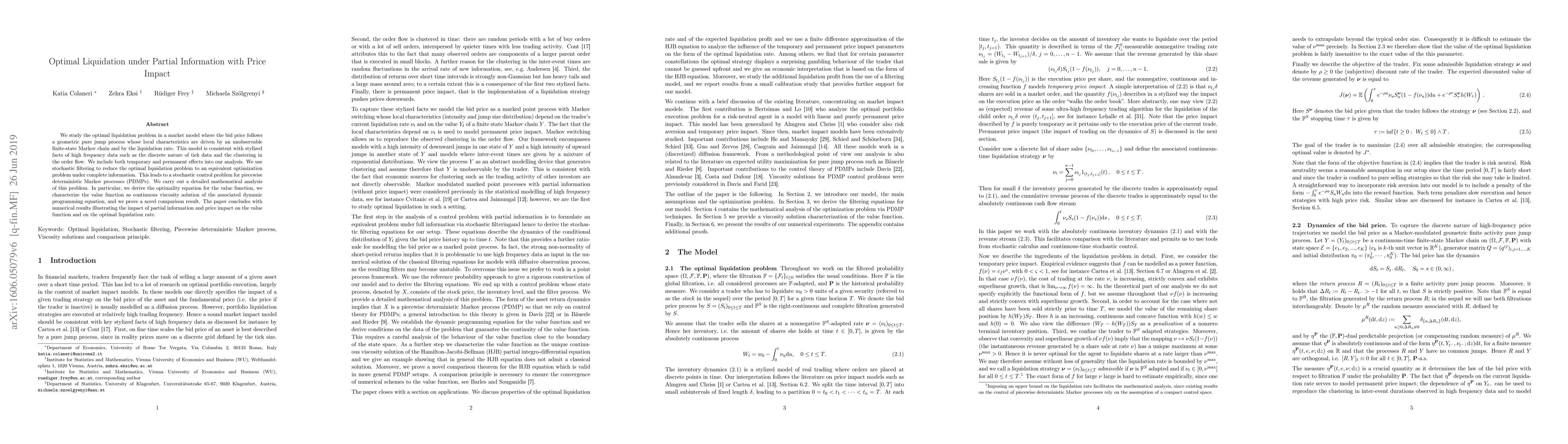

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal liquidation with temporary and permanent price impact, an application to cryptocurrencies

Hugo E. Ramirez, Julián Fernando Sanchez

Optimal Liquidation with Conditions on Minimum Price

Mervan Aksu, Alexandre Popier, Ali Devin Sezer

| Title | Authors | Year | Actions |

|---|

Comments (0)