Summary

This paper studies the optimal liquidation of stocks in the presence of temporary and permanent price impacts, and we focus in the case of cryptocurrencies. We start by presenting analytical solutions to the problem with linear temporary impact, and linear and quadratic permanent impact. Then, using data from the order book of the BNB cryptocurrency, we estimate the functional form of the temporary and permanent price impact in three different scenarios: underestimation, overestimation and average estimation, finding different functional forms for each scenario. Using finite differences and optimal policy iteration, we solve the problem numerically and observe interesting changes in the optimal liquidation policy when applying calibrated linear and power forms for the temporary and permanent price impacts. Then, with these optimal policies, we identify optimal liquidation trajectories and simulate the liquidation of initial inventories to compare the performance among the optimal strategies under different parametrizations and against a naive strategy. Finally, we characterize the optimal policies based on the functional form of the inventory and find that policies generating the highest revenue are those starting with a low trading rate and increasing it as time passes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

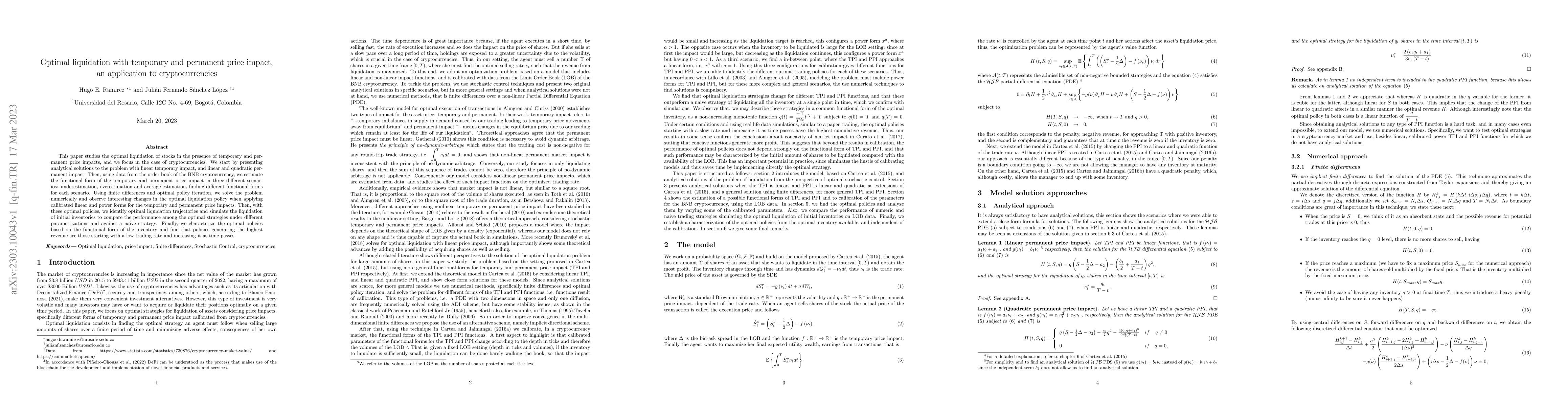

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)