Authors

Summary

We consider an optimal liquidation problem with instantaneous price impact and stochastic resilience for small instantaneous impact factors. Within our modelling framework, the optimal portfolio process converges to the solution of an optimal liquidation problem with general semimartingale controls when the instantaneous impact factor converges to zero. Our results provide a unified framework within which to embed the two most commonly used modelling frameworks in the liquidation literature and provide a microscopic foundation for the use of semimartingale liquidation strategies and the use of portfolio processes of unbounded variation. Our convergence results are based on novel convergence results for BSDEs with singular terminal conditions and novel representation results of BSDEs in terms of uniformly continuous functions of forward processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

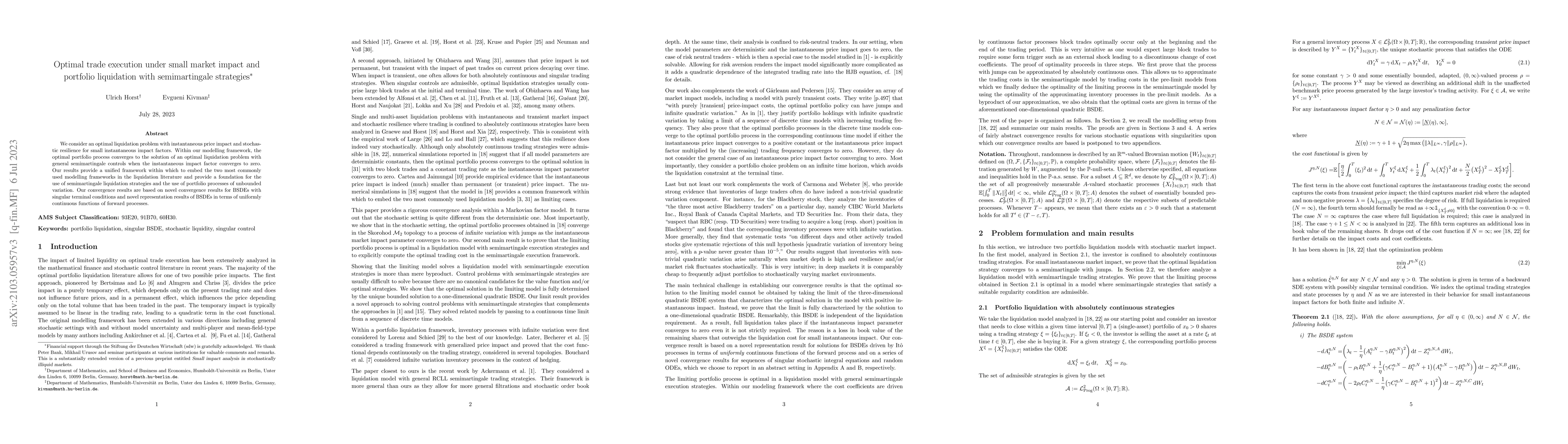

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Mean-Field Control Problem of Optimal Portfolio Liquidation with Semimartingale Strategies

Guanxing Fu, Xiaonyu Xia, Ulrich Horst

| Title | Authors | Year | Actions |

|---|

Comments (0)