Authors

Summary

In this paper we consider the asymptotic distributions of functionals of the sample covariance matrix and the sample mean vector obtained under the assumption that the matrix of observations has a matrix-variate location mixture of normal distributions. The central limit theorem is derived for the product of the sample covariance matrix and the sample mean vector. Moreover, we consider the product of the inverse sample covariance matrix and the mean vector for which the central limit theorem is established as well. All results are obtained under the large-dimensional asymptotic regime where the dimension $p$ and the sample size $n$ approach to infinity such that $p/n\to c\in[0 , +\infty)$ when the sample covariance matrix does not need to be invertible and $p/n\to c\in [0, 1)$ otherwise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

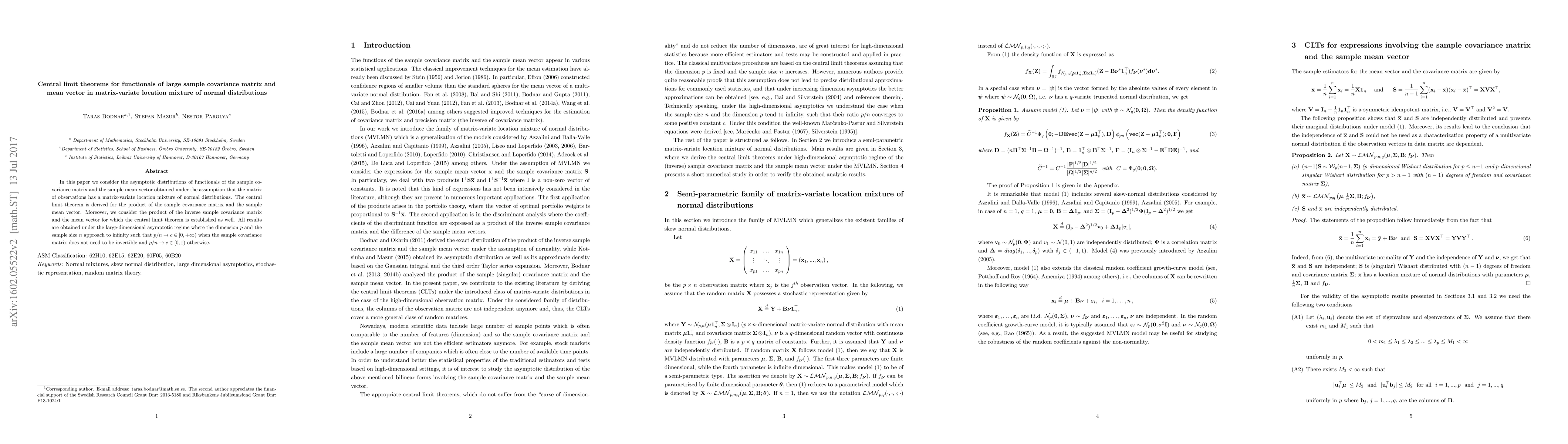

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinite mixtures of matrix-variate Poisson-log normal distributions for three-way count data

Paul D. McNicholas, Anjali Silva, Steven J. Rothstein et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)