Taras Bodnar

22 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A Closed-Form Solution of the Multi-Period Portfolio Choice Problem for a Quadratic Utility Function

In the present paper, we derive a closed-form solution of the multi-period portfolio choice problem for a quadratic utility function with and without a riskless asset. All results are derived under ...

On the Exact Solution of the Multi-Period Portfolio Choice Problem for an Exponential Utility under Return Predictability

In this paper we derive the exact solution of the multi-period portfolio choice problem for an exponential utility function under return predictability. It is assumed that the asset returns depend o...

Optimal Linear Shrinkage Estimator for Large Dimensional Precision Matrix

In this work we construct an optimal shrinkage estimator for the precision matrix in high dimensions. We consider the general asymptotics when the number of variables $p\rightarrow\infty$ and the sa...

Estimation of the Global Minimum Variance Portfolio in High Dimensions

We estimate the global minimum variance (GMV) portfolio in the high-dimensional case using results from random matrix theory. This approach leads to a shrinkage-type estimator which is distribution-...

Central limit theorems for functionals of large sample covariance matrix and mean vector in matrix-variate location mixture of normal distributions

In this paper we consider the asymptotic distributions of functionals of the sample covariance matrix and the sample mean vector obtained under the assumption that the matrix of observations has a m...

Optimal shrinkage-based portfolio selection in high dimensions

In this paper we estimate the mean-variance portfolio in the high-dimensional case using the recent results from the theory of random matrices. We construct a linear shrinkage estimator which is dis...

Reviving pseudo-inverses: Asymptotic properties of large dimensional Moore-Penrose and Ridge-type inverses with applications

In this paper, we derive high-dimensional asymptotic properties of the Moore-Penrose inverse and the ridge-type inverse of the sample covariance matrix. In particular, the analytical expressions of ...

Gibbs sampler approach for objective Bayeisan inference in elliptical multivariate random effects model

In this paper, we present the Bayesian inference procedures for the parameters of the multivariate random effects model derived under the assumption of an elliptically contoured distribution when th...

Estimation of sub-Gaussian random vectors using the method of moments

The sub-Gaussian stable distribution is a heavy-tailed elliptically contoured law which has interesting applications in signal processing and financial mathematics. This work addresses the problem o...

Volatility Sensitive Bayesian Estimation of Portfolio VaR and CVaR

In this paper, a new way to integrate volatility information for estimating value at risk (VaR) and conditional value at risk (CVaR) of a portfolio is suggested. The new method is developed from the...

Two is better than one: Regularized shrinkage of large minimum variance portfolio

In this paper we construct a shrinkage estimator of the global minimum variance (GMV) portfolio by a combination of two techniques: Tikhonov regularization and direct shrinkage of portfolio weights....

Is the empirical out-of-sample variance an informative risk measure for the high-dimensional portfolios?

The main contribution of this paper is the derivation of the asymptotic behaviour of the out-of-sample variance, the out-of-sample relative loss, and of their empirical counterparts in the high-dime...

Dynamic Shrinkage Estimation of the High-Dimensional Minimum-Variance Portfolio

In this paper, new results in random matrix theory are derived which allow us to construct a shrinkage estimator of the global minimum variance (GMV) portfolio when the shrinkage target is a random ...

Statistical inference for the EU portfolio in high dimensions

In this paper, using the shrinkage-based approach for portfolio weights and modern results from random matrix theory we construct an effective procedure for testing the efficiency of the expected ut...

Spectral analysis of large reflexive generalized inverse and Moore-Penrose inverse matrices

A reflexive generalized inverse and the Moore-Penrose inverse are often confused in statistical literature but in fact they have completely different behaviour in case the population covariance matr...

Sampling Distributions of Optimal Portfolio Weights and Characteristics in Low and Large Dimensions

Optimal portfolio selection problems are determined by the (unknown) parameters of the data generating process. If an investor wants to realise the position suggested by the optimal portfolios, he/s...

Mean-Variance Efficiency of Optimal Power and Logarithmic Utility Portfolios

We derive new results related to the portfolio choice problem for power and logarithmic utilities. Assuming that the portfolio returns follow an approximate log-normal distribution, the closed-form ...

Bayesian mean-variance analysis: Optimal portfolio selection under parameter uncertainty

The paper solves the problem of optimal portfolio choice when the parameters of the asset returns distribution, like the mean vector and the covariance matrix are unknown and have to be estimated by...

Tests for the weights of the global minimum variance portfolio in a high-dimensional setting

In this study, we construct two tests for the weights of the global minimum variance portfolio (GMVP) in a high-dimensional setting, namely, when the number of assets $p$ depends on the sample size ...

Testing for Independence of Large Dimensional Vectors

In this paper new tests for the independence of two high-dimensional vectors are investigated. We consider the case where the dimension of the vectors increases with the sample size and propose mult...

Bayesian Inference of the Multi-Period Optimal Portfolio for an Exponential Utility

We consider the estimation of the multi-period optimal portfolio obtained by maximizing an exponential utility. Employing Jeffreys' non-informative prior and the conjugate informative prior, we deri...

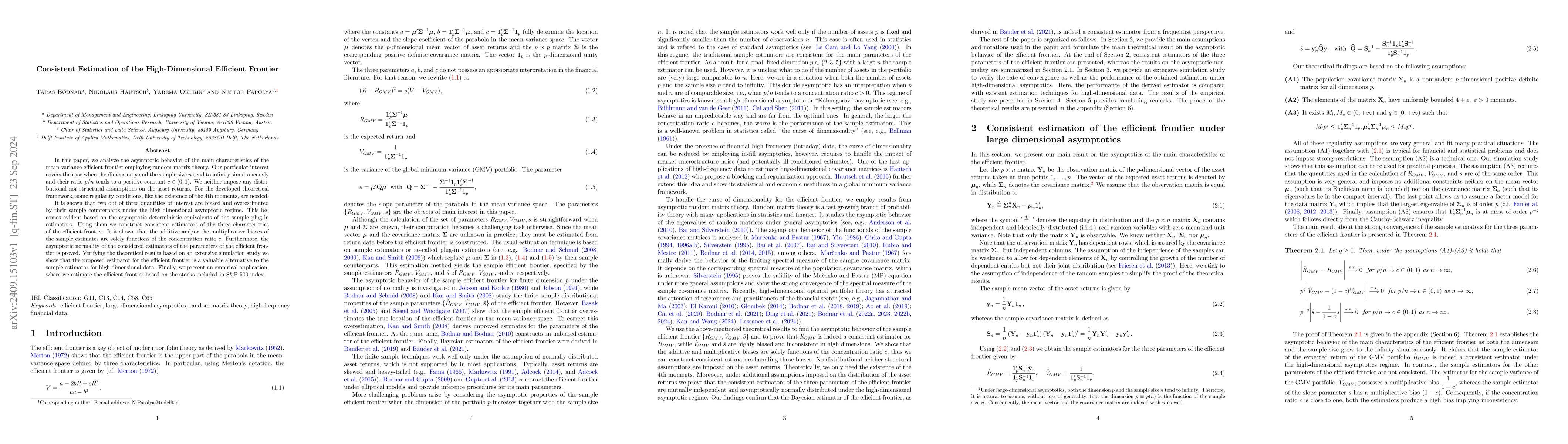

Consistent Estimation of the High-Dimensional Efficient Frontier

In this paper, we analyze the asymptotic behavior of the main characteristics of the mean-variance efficient frontier employing random matrix theory. Our particular interest covers the case when the d...