Authors

Summary

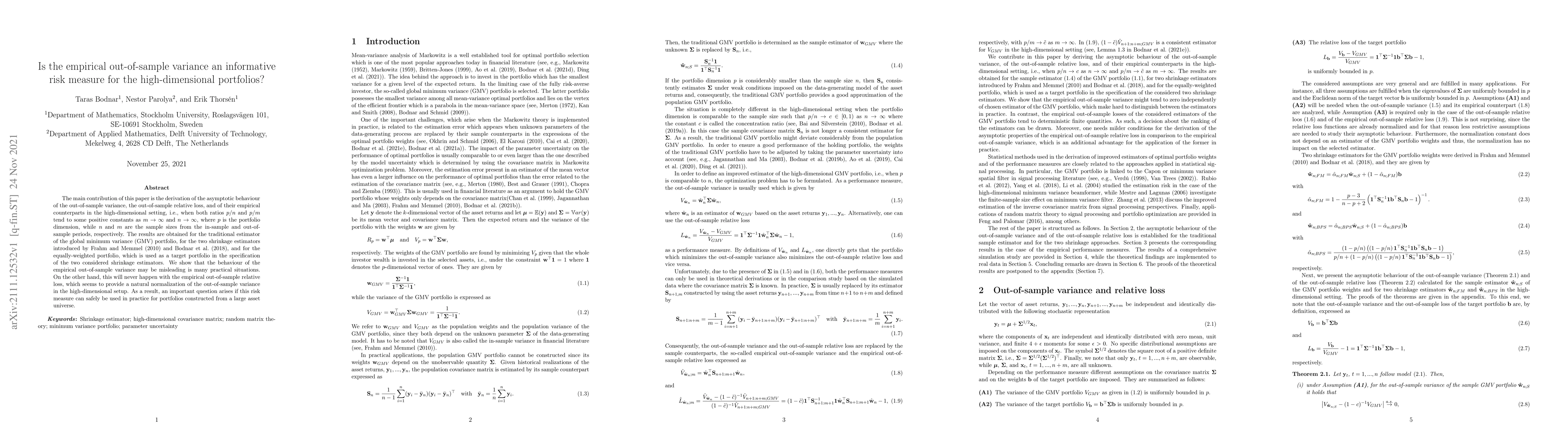

The main contribution of this paper is the derivation of the asymptotic behaviour of the out-of-sample variance, the out-of-sample relative loss, and of their empirical counterparts in the high-dimensional setting, i.e., when both ratios $p/n$ and $p/m$ tend to some positive constants as $m\to\infty$ and $n\to\infty$, where $p$ is the portfolio dimension, while $n$ and $m$ are the sample sizes from the in-sample and out-of-sample periods, respectively. The results are obtained for the traditional estimator of the global minimum variance (GMV) portfolio, for the two shrinkage estimators introduced by \cite{frahm2010} and \cite{bodnar2018estimation}, and for the equally-weighted portfolio, which is used as a target portfolio in the specification of the two considered shrinkage estimators. We show that the behaviour of the empirical out-of-sample variance may be misleading is many practical situations. On the other hand, this will never happen with the empirical out-of-sample relative loss, which seems to provide a natural normalization of the out-of-sample variance in the high-dimensional setup. As a result, an important question arises if this risk measure can safely be used in practice for portfolios constructed from a large asset universe.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)