Summary

The paper solves the problem of optimal portfolio choice when the parameters of the asset returns distribution, like the mean vector and the covariance matrix are unknown and have to be estimated by using historical data of the asset returns. The new approach employs the Bayesian posterior predictive distribution which is the distribution of the future realization of the asset returns given the observable sample. The parameters of the posterior predictive distributions are functions of the observed data values and, consequently, the solution of the optimization problem is expressed in terms of data only and does not depend on unknown quantities. In contrast, the optimization problem of the traditional approach is based on unknown quantities which are estimated in the second step leading to a suboptimal solution. We also derive a very useful stochastic representation of the posterior predictive distribution whose application leads not only to the solution of the considered optimization problem, but provides the posterior predictive distribution of the optimal portfolio return used to construct a prediction interval. A Bayesian efficient frontier, a set of optimal portfolios obtained by employing the posterior predictive distribution, is constructed as well. Theoretically and using real data we show that the Bayesian efficient frontier outperforms the sample efficient frontier, a common estimator of the set of optimal portfolios known to be overoptimistic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

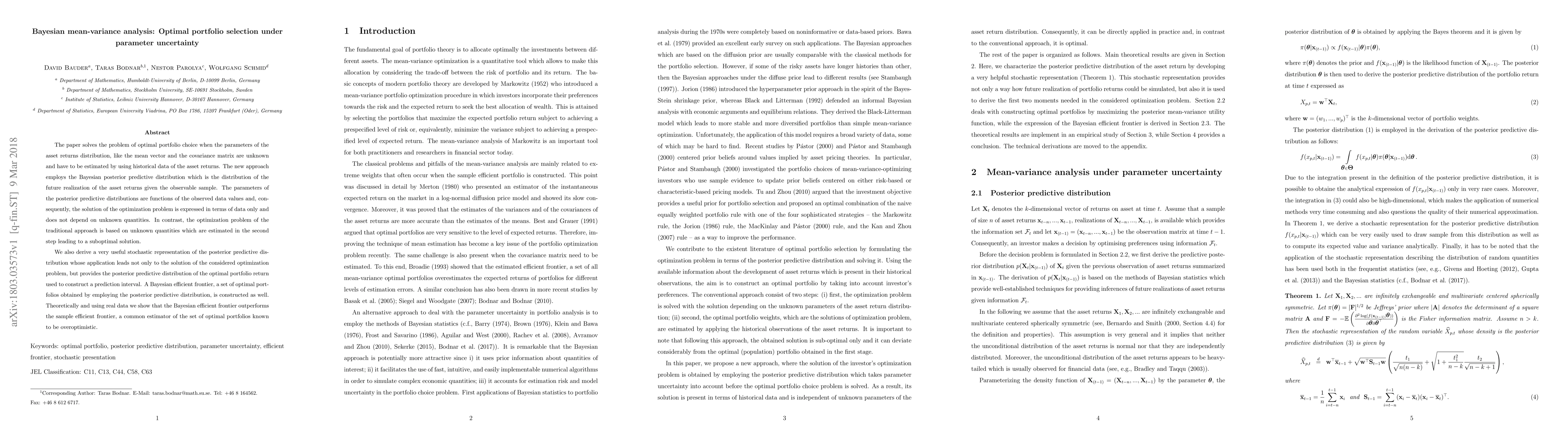

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)