Summary

In this paper, using the shrinkage-based approach for portfolio weights and modern results from random matrix theory we construct an effective procedure for testing the efficiency of the expected utility (EU) portfolio and discuss the asymptotic behavior of the proposed test statistic under the high-dimensional asymptotic regime, namely when the number of assets $p$ increases at the same rate as the sample size $n$ such that their ratio $p/n$ approaches a positive constant $c\in(0,1)$ as $n\to\infty$. We provide an extensive simulation study where the power function and receiver operating characteristic curves of the test are analyzed. In the empirical study, the methodology is applied to the returns of S\&P 500 constituents.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

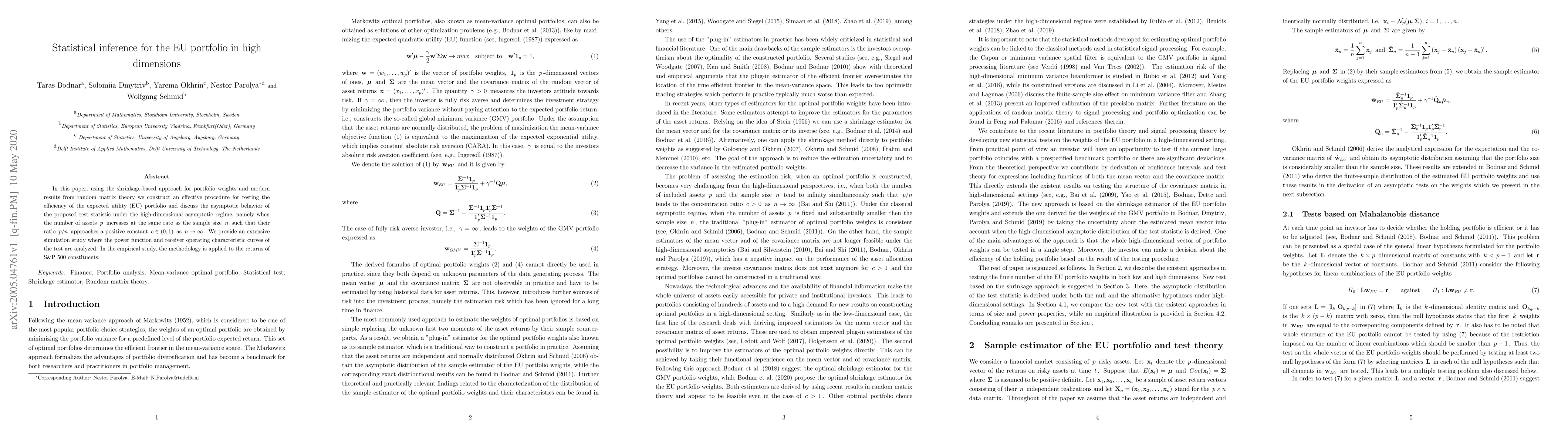

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNavigating Complexity: Constrained Portfolio Analysis in High Dimensions with Tracking Error and Weight Constraints

Qingliang Fan, Yingying Li, Mehmet Caner

Optimal shrinkage-based portfolio selection in high dimensions

Taras Bodnar, Nestor Parolya, Yarema Okhrin

| Title | Authors | Year | Actions |

|---|

Comments (0)