Authors

Summary

We propose a fast and flexible method to scale multivariate return volatility predictions up to high-dimensions using a dynamic risk factor model. Our approach increases parsimony via time-varying sparsity on factor loadings and is able to sequentially learn the use of constant or time-varying parameters and volatilities. We show in a dynamic portfolio allocation problem with 452 stocks from the S&P 500 index that our dynamic risk factor model is able to produce more stable and sparse predictions, achieving not just considerable portfolio performance improvements but also higher utility gains for the mean-variance investor compared to the traditional Wishart benchmark and the passive investment on the market index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

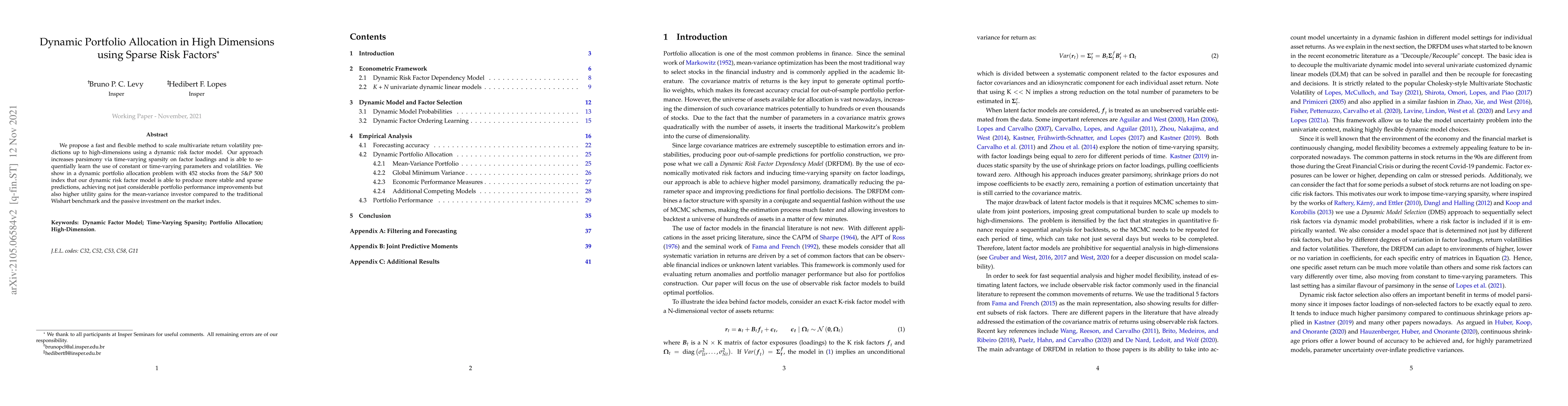

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Optimization of Portfolio Allocation Using Deep Reinforcement Learning

Gang Huang, Qingyang Song, Xiaohua Zhou

Risk Budgeting Allocation for Dynamic Risk Measures

Sebastian Jaimungal, Silvana M. Pesenti, Yuri F. Saporito et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)