Authors

Summary

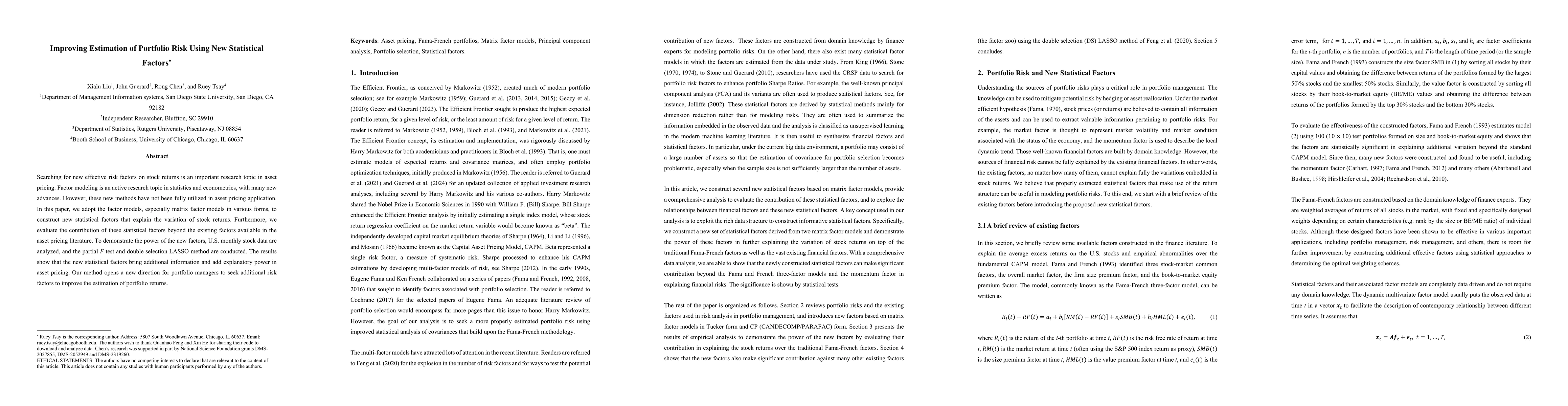

Searching for new effective risk factors on stock returns is an important research topic in asset pricing. Factor modeling is an active research topic in statistics and econometrics, with many new advances. However, these new methods have not been fully utilized in asset pricing application. In this paper, we adopt the factor models, especially matrix factor models in various forms, to construct new statistical factors that explain the variation of stock returns. Furthermore, we evaluate the contribution of these statistical factors beyond the existing factors available in the asset pricing literature. To demonstrate the power of the new factors, U.S. monthly stock data are analyzed and the partial F test and double selection LASSO method are conducted. The results show that the new statistical factors bring additional information and add explanatory power in asset pricing. Our method opens a new direction for portfolio managers to seek additional risk factors to improve the estimation of portfolio returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)