Authors

Summary

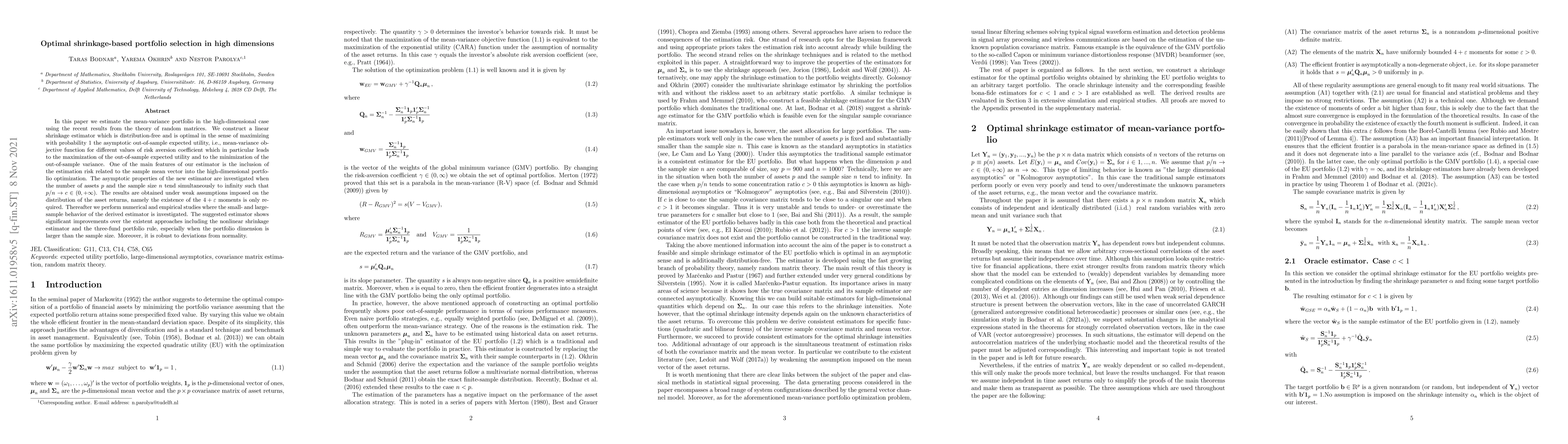

In this paper we estimate the mean-variance portfolio in the high-dimensional case using the recent results from the theory of random matrices. We construct a linear shrinkage estimator which is distribution-free and is optimal in the sense of maximizing with probability $1$ the asymptotic out-of-sample expected utility, i.e., mean-variance objective function for different values of risk aversion coefficient which in particular leads to the maximization of the out-of-sample expected utility and to the minimization of the out-of-sample variance. One of the main features of our estimator is the inclusion of the estimation risk related to the sample mean vector into the high-dimensional portfolio optimization. The asymptotic properties of the new estimator are investigated when the number of assets $p$ and the sample size $n$ tend simultaneously to infinity such that $p/n \rightarrow c\in (0,+\infty)$. The results are obtained under weak assumptions imposed on the distribution of the asset returns, namely the existence of the $4+\varepsilon$ moments is only required. Thereafter we perform numerical and empirical studies where the small- and large-sample behavior of the derived estimator is investigated. The suggested estimator shows significant improvements over the existent approaches including the nonlinear shrinkage estimator and the three-fund portfolio rule, especially when the portfolio dimension is larger than the sample size. Moreover, it is robust to deviations from normality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlack-Litterman, Bayesian Shrinkage, and Factor Models in Portfolio Selection: You Can Have It All

Kwong Yu Chong

Randomized Signature Methods in Optimal Portfolio Selection

Josef Teichmann, Erdinc Akyildirim, Matteo Gambara et al.

Dynamic Shrinkage Estimation of the High-Dimensional Minimum-Variance Portfolio

Taras Bodnar, Nestor Parolya, Erik Thorsen

| Title | Authors | Year | Actions |

|---|

Comments (0)