Summary

We estimate the global minimum variance (GMV) portfolio in the high-dimensional case using results from random matrix theory. This approach leads to a shrinkage-type estimator which is distribution-free and it is optimal in the sense of minimizing the out-of-sample variance. Its asymptotic properties are investigated assuming that the number of assets $p$ depends on the sample size $n$ such that $\frac{p}{n}\rightarrow c\in (0,+\infty)$ as $n$ tends to infinity. The results are obtained under weak assumptions imposed on the distribution of the asset returns, namely it is only required the fourth moments existence. Furthermore, we make no assumption on the upper bound of the spectrum of the covariance matrix. As a result, the theoretical findings are also valid if the dependencies between the asset returns are described by a factor model which appears to be very popular in financial literature nowadays. This is also well-documented in a numerical study where the small- and large-sample behavior of the derived estimator are compared with existing estimators of the GMV portfolio. The resulting estimator shows significant improvements and it turns out to be robust to the deviations from normality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

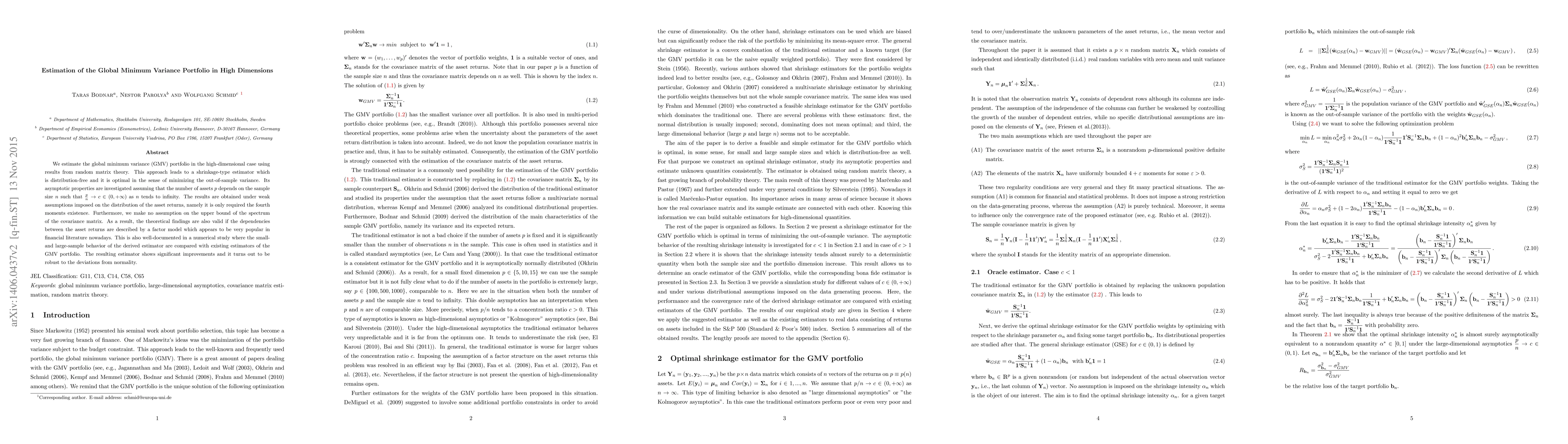

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Shrinkage Estimation of the High-Dimensional Minimum-Variance Portfolio

Taras Bodnar, Nestor Parolya, Erik Thorsen

| Title | Authors | Year | Actions |

|---|

Comments (0)