Authors

Summary

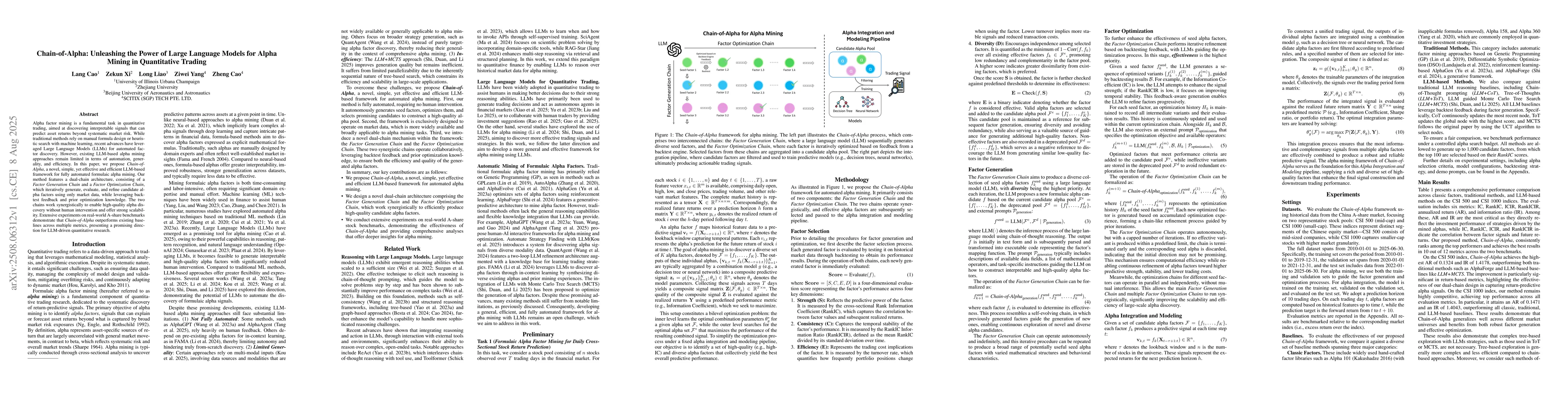

Alpha factor mining is a fundamental task in quantitative trading, aimed at discovering interpretable signals that can predict asset returns beyond systematic market risk. While traditional methods rely on manual formula design or heuristic search with machine learning, recent advances have leveraged Large Language Models (LLMs) for automated factor discovery. However, existing LLM-based alpha mining approaches remain limited in terms of automation, generality, and efficiency. In this paper, we propose Chain-of-Alpha, a novel, simple, yet effective and efficient LLM-based framework for fully automated formulaic alpha mining. Our method features a dual-chain architecture, consisting of a Factor Generation Chain and a Factor Optimization Chain, which iteratively generate, evaluate, and refine candidate alpha factors using only market data, while leveraging backtest feedback and prior optimization knowledge. The two chains work synergistically to enable high-quality alpha discovery without human intervention and offer strong scalability. Extensive experiments on real-world A-share benchmarks demonstrate that Chain-of-Alpha outperforms existing baselines across multiple metrics, presenting a promising direction for LLM-driven quantitative research.

AI Key Findings

Generated Aug 15, 2025

Methodology

The paper introduces Chain-of-Alpha, a novel framework for automated alpha mining in quantitative trading using Large Language Models (LLMs). It employs a dual-chain architecture consisting of a Factor Generation Chain and a Factor Optimization Chain, which iteratively generate, evaluate, and refine candidate alpha factors using market data and backtest feedback.

Key Results

- Chain-of-Alpha outperforms existing baselines across multiple metrics on real-world A-share benchmarks.

- The dual-chain design effectively captures return-predictive alpha signals, particularly evident in return-based metrics.

- The framework demonstrates strong scalability and generalization across different market universes.

- Experiments show that complex tree-based exploration methods, such as those used in ToT or MCTS, are not necessary and are less efficient compared to chain-based approaches.

Significance

This research presents a significant step toward LLM-driven quantitative research by providing an automated, efficient, and scalable method for alpha factor mining, which can enhance trading performance and reduce human intervention in quantitative trading strategies.

Technical Contribution

The Chain-of-Alpha framework, with its dual-chain architecture, offers a novel and efficient approach to automated alpha mining using LLMs, enhancing the traditional methods of manual formula design or heuristic search with machine learning.

Novelty

Chain-of-Alpha distinguishes itself by providing a fully automated, efficient, and scalable solution for alpha factor mining, leveraging the power of LLMs to generate and optimize factors without human intervention, unlike previous methods that relied on manual design or limited machine learning techniques.

Limitations

- The study is limited to the A-share market in China, so its applicability to other markets remains to be explored.

- The effectiveness of Chain-of-Alpha relies on the quality and availability of historical market data for training and backtesting.

Future Work

- Investigate the applicability of Chain-of-Alpha to other financial markets beyond the A-share market.

- Explore the integration of Chain-of-Alpha with real-time data streams for live trading applications.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAlpha-GPT: Human-AI Interactive Alpha Mining for Quantitative Investment

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

Synergistic Formulaic Alpha Generation for Quantitative Trading based on Reinforcement Learning

Yong-Hoon Choi, Hong-Gi Shin, Sukhyun Jeong et al.

Alpha-GPT 2.0: Human-in-the-Loop AI for Quantitative Investment

Jian Guo, Saizhuo Wang, Hang Yuan

Navigating the Alpha Jungle: An LLM-Powered MCTS Framework for Formulaic Factor Mining

Jian Li, Yu Shi, Yitong Duan

Comments (0)