Authors

Summary

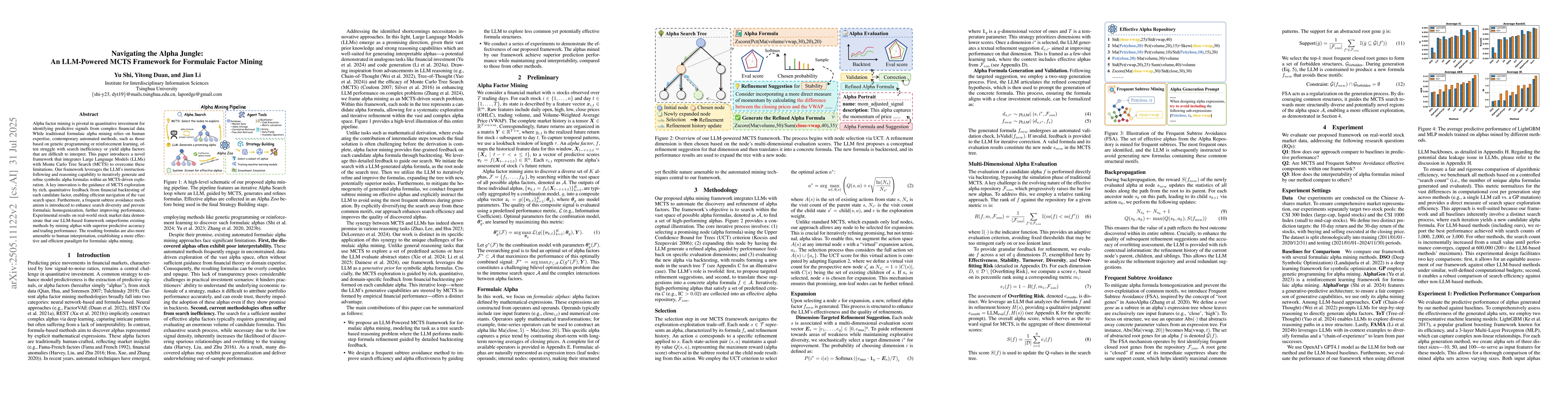

Alpha factor mining is pivotal in quantitative investment for identifying predictive signals from complex financial data. While traditional formulaic alpha mining relies on human expertise, contemporary automated methods, such as those based on genetic programming or reinforcement learning, often struggle with search inefficiency or yield alpha factors that are difficult to interpret. This paper introduces a novel framework that integrates Large Language Models (LLMs) with Monte Carlo Tree Search (MCTS) to overcome these limitations. Our framework leverages the LLM's instruction-following and reasoning capability to iteratively generate and refine symbolic alpha formulas within an MCTS-driven exploration. A key innovation is the guidance of MCTS exploration by rich, quantitative feedback from financial backtesting of each candidate factor, enabling efficient navigation of the vast search space. Furthermore, a frequent subtree avoidance mechanism is introduced to enhance search diversity and prevent formulaic homogenization, further improving performance. Experimental results on real-world stock market data demonstrate that our LLM-based framework outperforms existing methods by mining alphas with superior predictive accuracy and trading performance. The resulting formulas are also more amenable to human interpretation, establishing a more effective and efficient paradigm for formulaic alpha mining.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlphaForge: A Framework to Mine and Dynamically Combine Formulaic Alpha Factors

Hao Shi, Cuicui Luo, Weili Song et al.

QuantFactor REINFORCE: Mining Steady Formulaic Alpha Factors with Variance-bounded REINFORCE

Peng Yang, Junjie Zhao, Chengxi Zhang et al.

Synergistic Formulaic Alpha Generation for Quantitative Trading based on Reinforcement Learning

Yong-Hoon Choi, Hong-Gi Shin, Sukhyun Jeong et al.

No citations found for this paper.

Comments (0)