Authors

Summary

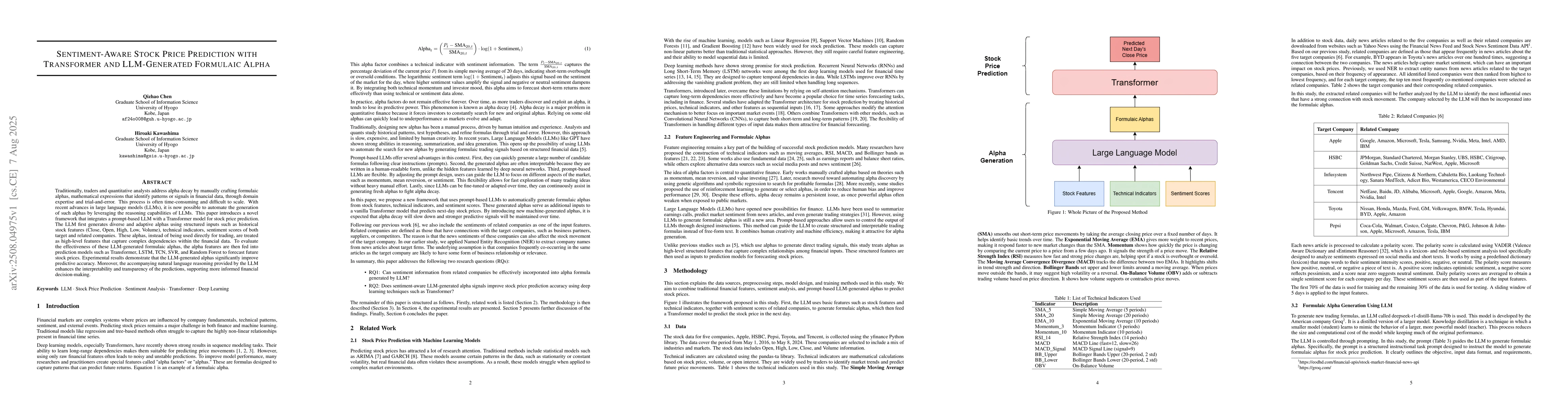

Traditionally, traders and quantitative analysts address alpha decay by manually crafting formulaic alphas, mathematical expressions that identify patterns or signals in financial data, through domain expertise and trial-and-error. This process is often time-consuming and difficult to scale. With recent advances in large language models (LLMs), it is now possible to automate the generation of such alphas by leveraging the reasoning capabilities of LLMs. This paper introduces a novel framework that integrates a prompt-based LLM with a Transformer model for stock price prediction. The LLM first generates diverse and adaptive alphas using structured inputs such as historical stock features (Close, Open, High, Low, Volume), technical indicators, sentiment scores of both target and related companies. These alphas, instead of being used directly for trading, are treated as high-level features that capture complex dependencies within the financial data. To evaluate the effectiveness of these LLM-generated formulaic alphas, the alpha features are then fed into prediction models such as Transformer, LSTM, TCN, SVR, and Random Forest to forecast future stock prices. Experimental results demonstrate that the LLM-generated alphas significantly improve predictive accuracy. Moreover, the accompanying natural language reasoning provided by the LLM enhances the interpretability and transparency of the predictions, supporting more informed financial decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinGPT: Enhancing Sentiment-Based Stock Movement Prediction with Dissemination-Aware and Context-Enriched LLMs

Hongyang Yang, Boyu Zhang, Christina Dan Wang et al.

GRUvader: Sentiment-Informed Stock Market Prediction

Bayode Ogunleye, Olamilekan Shobayo, Akhila Mamillapalli et al.

Transformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

Comments (0)