Authors

Summary

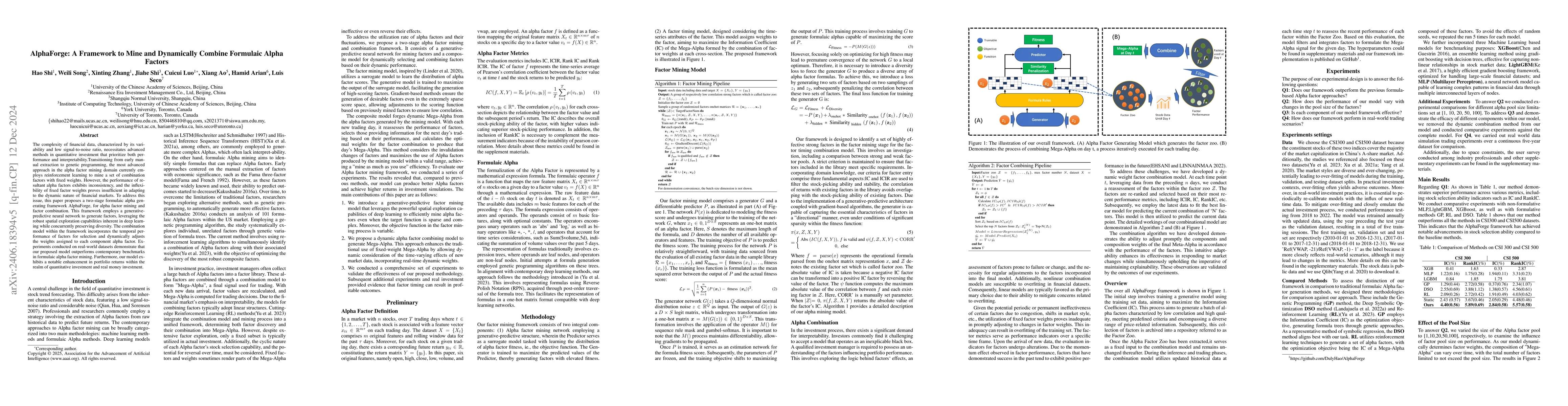

The variability and low signal-to-noise ratio in financial data, combined with the necessity for interpretability, make the alpha factor mining workflow a crucial component of quantitative investment. Transitioning from early manual extraction to genetic programming, the most advanced approach in this domain currently employs reinforcement learning to mine a set of combination factors with fixed weights. However, the performance of resultant alpha factors exhibits inconsistency, and the inflexibility of fixed factor weights proves insufficient in adapting to the dynamic nature of financial markets. To address this issue, this paper proposes a two-stage formulaic alpha generating framework AlphaForge, for alpha factor mining and factor combination. This framework employs a generative-predictive neural network to generate factors, leveraging the robust spatial exploration capabilities inherent in deep learning while concurrently preserving diversity. The combination model within the framework incorporates the temporal performance of factors for selection and dynamically adjusts the weights assigned to each component alpha factor. Experiments conducted on real-world datasets demonstrate that our proposed model outperforms contemporary benchmarks in formulaic alpha factor mining. Furthermore, our model exhibits a notable enhancement in portfolio returns within the realm of quantitative investment.

AI Key Findings

Generated Sep 02, 2025

Methodology

This research introduces AlphaForge, a two-stage framework for mining and dynamically combining formulaic alpha factors in quantitative investment. It utilizes a generative-predictive neural network for factor generation and a combination model that adjusts weights based on temporal performance.

Key Results

- AlphaForge outperforms contemporary benchmarks in formulaic alpha factor mining.

- The model enhances portfolio returns in quantitative investment.

- Dynamic factor combination improves performance compared to fixed weights.

- The framework effectively mitigates overfitting concerns common in financial datasets.

- AlphaForge's ability to adjust factor weights in response to market changes is validated by experimental results.

Significance

This research is significant as it addresses the inflexibility of fixed factor weights in adapting to dynamic financial markets, thereby improving the performance of alpha factors and portfolio returns in quantitative investment.

Technical Contribution

The primary technical contribution is the development of AlphaForge, a novel framework that combines generative-predictive neural networks for factor mining and a dynamic combination model for adjusting factor weights based on performance.

Novelty

AlphaForge distinguishes itself by introducing a dynamic weight factor combination model, which adapts to the changing nature of financial markets, unlike previous methods that relied on fixed factor weights.

Limitations

- The study was conducted on real-world datasets, which may not cover all market conditions.

- The model's performance might vary with unforeseen market shifts or congestion.

Future Work

- Explore the application of AlphaForge in other domains beyond quantitative investment.

- Investigate the framework's performance with additional datasets and under varying market conditions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerating Synergistic Formulaic Alpha Collections via Reinforcement Learning

Qing He, Jia He, Shuo Yu et al.

QuantFactor REINFORCE: Mining Steady Formulaic Alpha Factors with Variance-bounded REINFORCE

Peng Yang, Junjie Zhao, Chengxi Zhang et al.

Navigating the Alpha Jungle: An LLM-Powered MCTS Framework for Formulaic Factor Mining

Jian Li, Yu Shi, Yitong Duan

Synergistic Formulaic Alpha Generation for Quantitative Trading based on Reinforcement Learning

Yong-Hoon Choi, Hong-Gi Shin, Sukhyun Jeong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)