Xiang Ao

20 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

AlphaForge: A Framework to Mine and Dynamically Combine Formulaic Alpha Factors

The variability and low signal-to-noise ratio in financial data, combined with the necessity for interpretability, make the alpha factor mining workflow a crucial component of quantitative investment....

LOGIN: A Large Language Model Consulted Graph Neural Network Training Framework

Recent prevailing works on graph machine learning typically follow a similar methodology that involves designing advanced variants of graph neural networks (GNNs) to maintain the superior performanc...

EFSA: Towards Event-Level Financial Sentiment Analysis

In this paper, we extend financial sentiment analysis~(FSA) to event-level since events usually serve as the subject of the sentiment in financial text. Though extracting events from the financial t...

Generating Synergistic Formulaic Alpha Collections via Reinforcement Learning

In the field of quantitative trading, it is common practice to transform raw historical stock data into indicative signals for the market trend. Such signals are called alpha factors. Alphas in form...

Reliable Representations Make A Stronger Defender: Unsupervised Structure Refinement for Robust GNN

Benefiting from the message passing mechanism, Graph Neural Networks (GNNs) have been successful on flourish tasks over graph data. However, recent studies have shown that attackers can catastrophic...

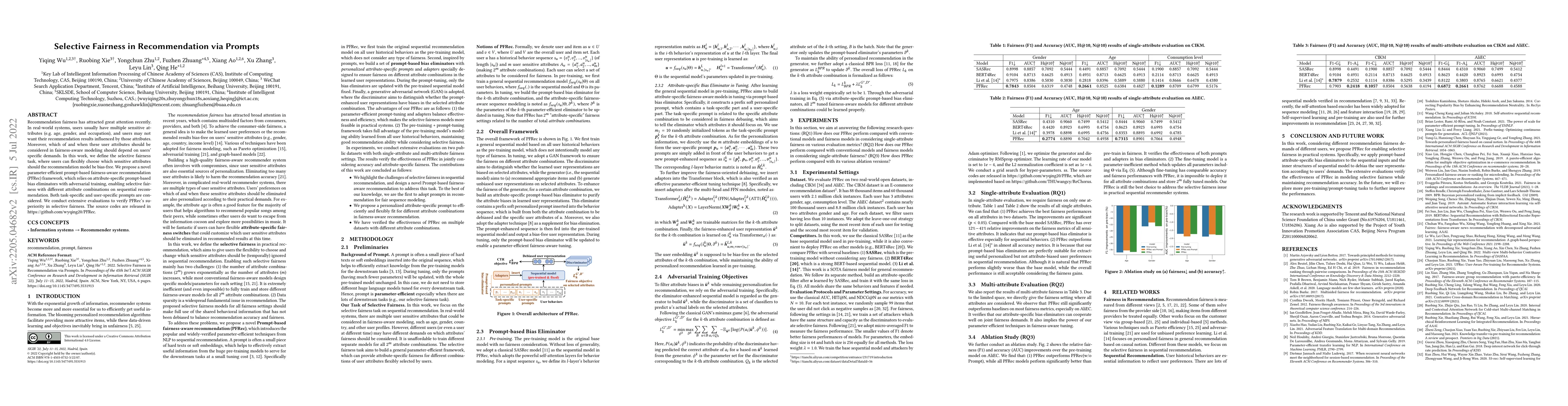

Selective Fairness in Recommendation via Prompts

Recommendation fairness has attracted great attention recently. In real-world systems, users usually have multiple sensitive attributes (e.g. age, gender, and occupation), and users may not want the...

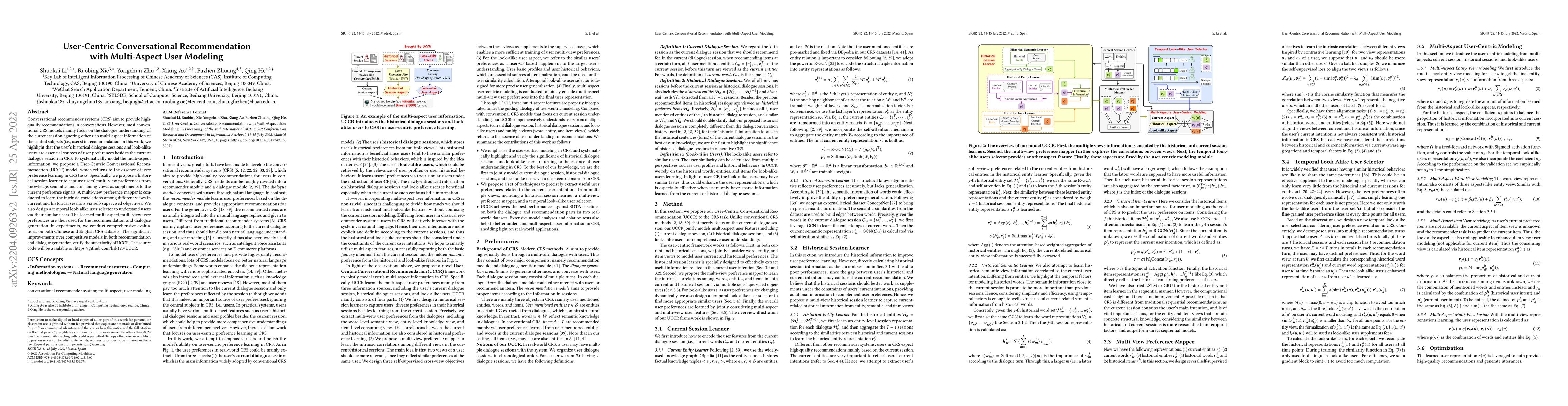

User-Centric Conversational Recommendation with Multi-Aspect User Modeling

Conversational recommender systems (CRS) aim to provide highquality recommendations in conversations. However, most conventional CRS models mainly focus on the dialogue understanding of the current ...

Multi-view Multi-behavior Contrastive Learning in Recommendation

Multi-behavior recommendation (MBR) aims to jointly consider multiple behaviors to improve the target behavior's performance. We argue that MBR models should: (1) model the coarse-grained commonalit...

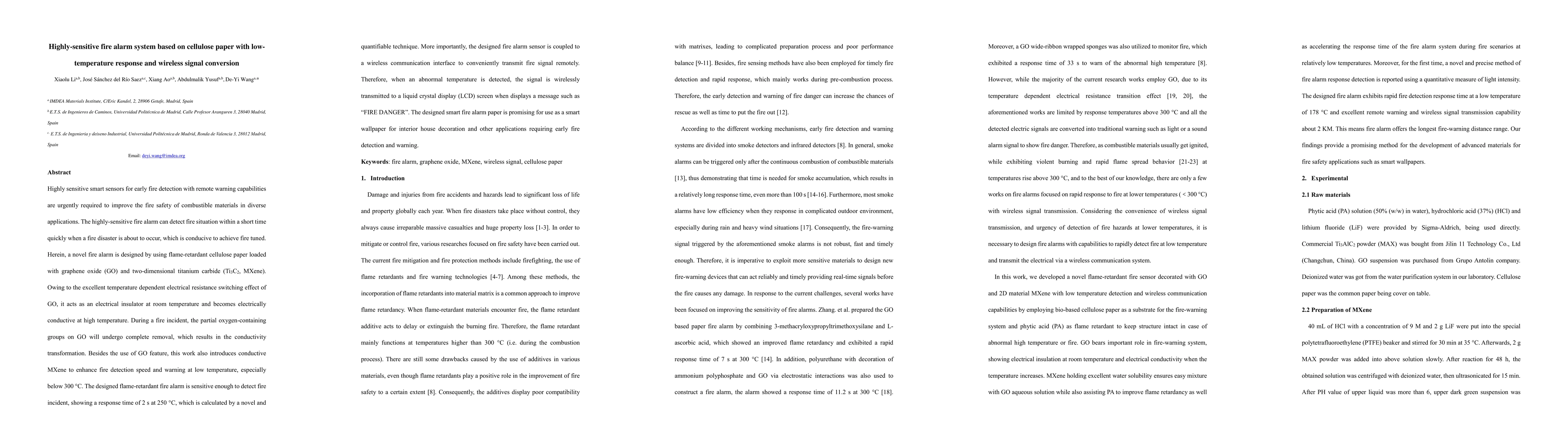

Highly sensitive fire alarm system based on cellulose paper with low temperature response and wireless signal conversion

Highly sensitive smart sensors for early fire detection with remote warning capabilities are urgently required to improve the fire safety of combustible materials in diverse applications. The highly...

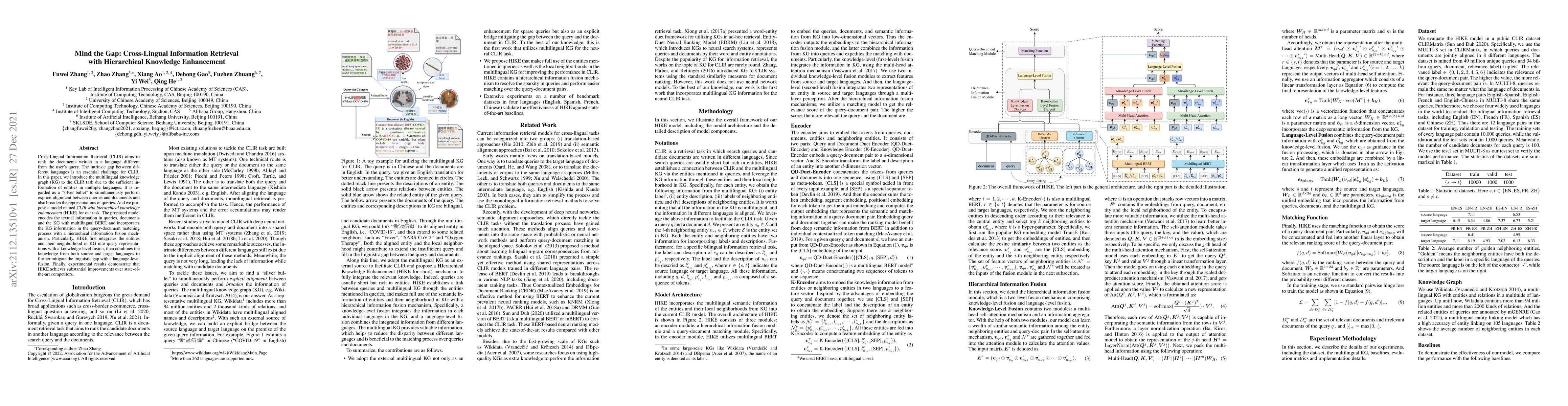

Mind the Gap: Cross-Lingual Information Retrieval with Hierarchical Knowledge Enhancement

Cross-Lingual Information Retrieval (CLIR) aims to rank the documents written in a language different from the user's query. The intrinsic gap between different languages is an essential challenge f...

Defending Against Backdoor Attacks in Natural Language Generation

The frustratingly fragile nature of neural network models make current natural language generation (NLG) systems prone to backdoor attacks and generate malicious sequences that could be sexist or of...

Sentence Similarity Based on Contexts

Existing methods to measure sentence similarity are faced with two challenges: (1) labeled datasets are usually limited in size, making them insufficient to train supervised neural models; (2) there...

Adapting Vision-Language Models to Open Classes via Test-Time Prompt Tuning

Adapting pre-trained models to open classes is a challenging problem in machine learning. Vision-language models fully explore the knowledge of text modality, demonstrating strong zero-shot recognitio...

Financial Risk Assessment via Long-term Payment Behavior Sequence Folding

Online inclusive financial services encounter significant financial risks due to their expansive user base and low default costs. By real-world practice, we reveal that utilizing longer-term user paym...

Controlling Large Language Models Through Concept Activation Vectors

As large language models (LLMs) are widely deployed across various domains, the ability to control their generated outputs has become more critical. This control involves aligning LLMs outputs with hu...

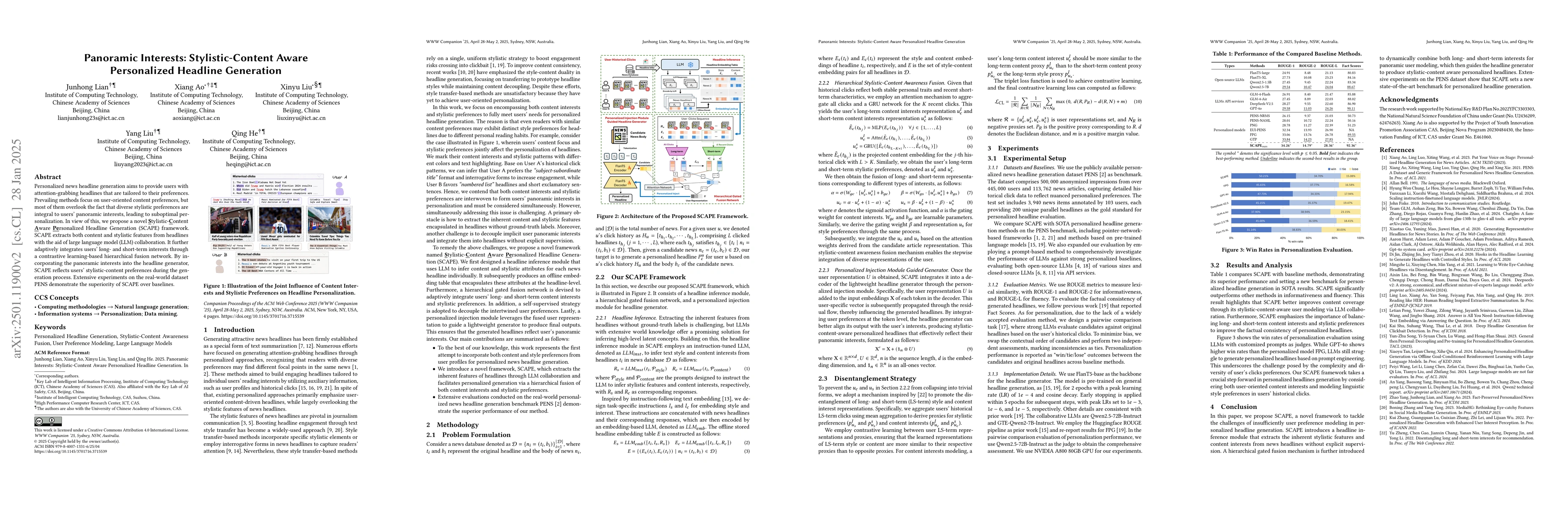

Panoramic Interests: Stylistic-Content Aware Personalized Headline Generation

Personalized news headline generation aims to provide users with attention-grabbing headlines that are tailored to their preferences. Prevailing methods focus on user-oriented content preferences, but...

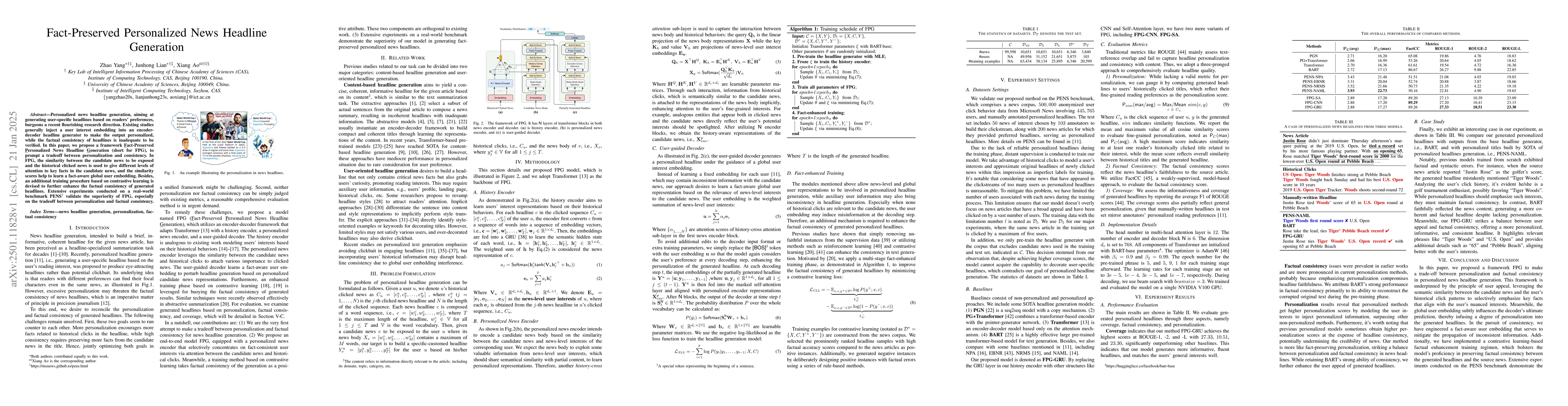

Fact-Preserved Personalized News Headline Generation

Personalized news headline generation, aiming at generating user-specific headlines based on readers' preferences, burgeons a recent flourishing research direction. Existing studies generally inject a...

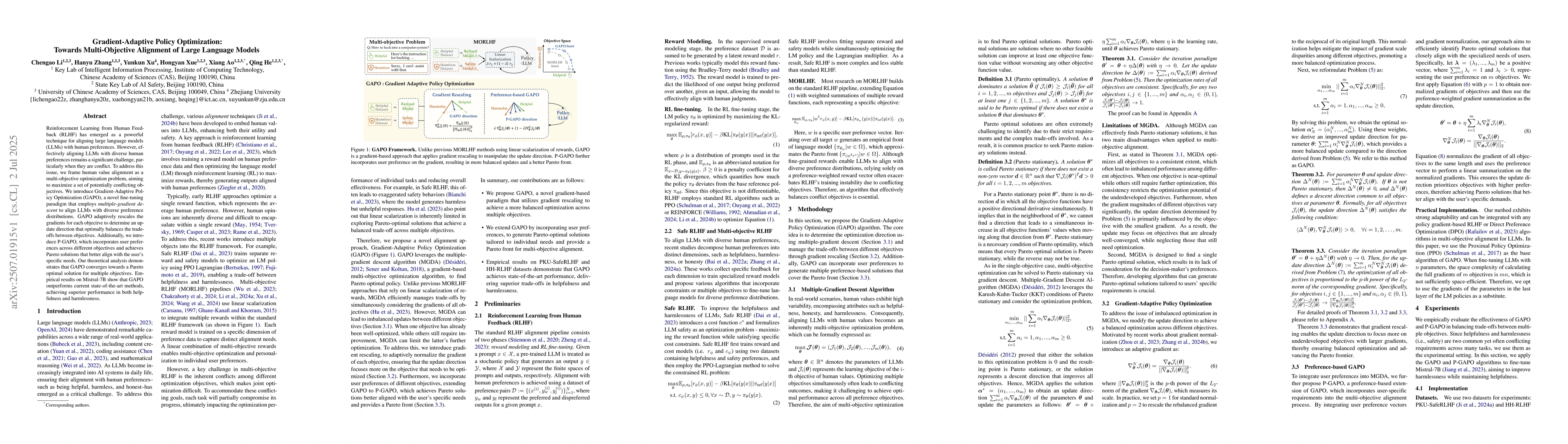

Gradient-Adaptive Policy Optimization: Towards Multi-Objective Alignment of Large Language Models

Reinforcement Learning from Human Feedback (RLHF) has emerged as a powerful technique for aligning large language models (LLMs) with human preferences. However, effectively aligning LLMs with diverse ...

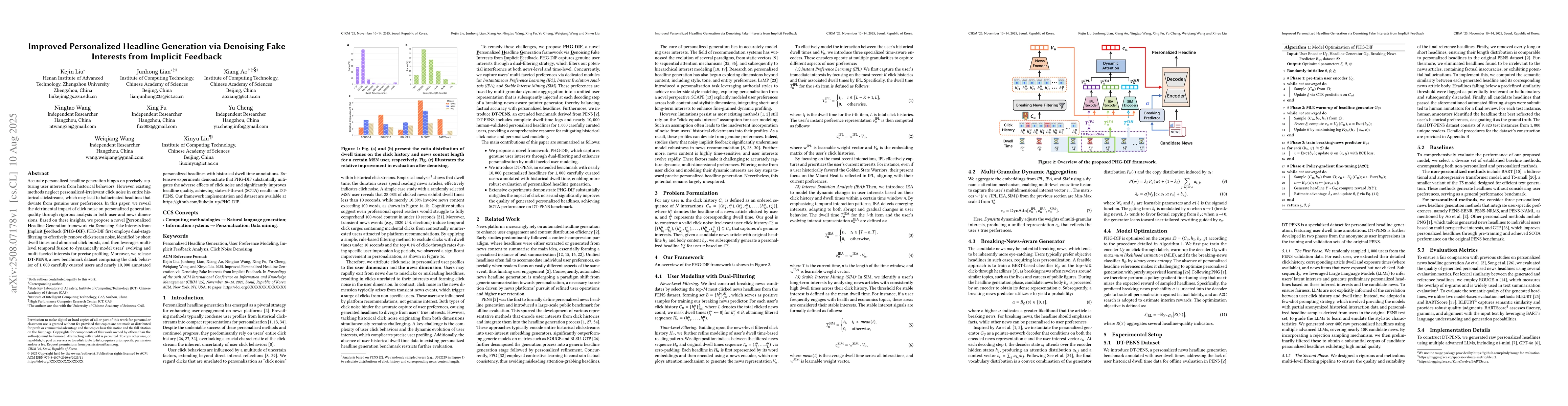

Improved Personalized Headline Generation via Denoising Fake Interests from Implicit Feedback

Accurate personalized headline generation hinges on precisely capturing user interests from historical behaviors. However, existing methods neglect personalized-irrelevant click noise in entire histor...

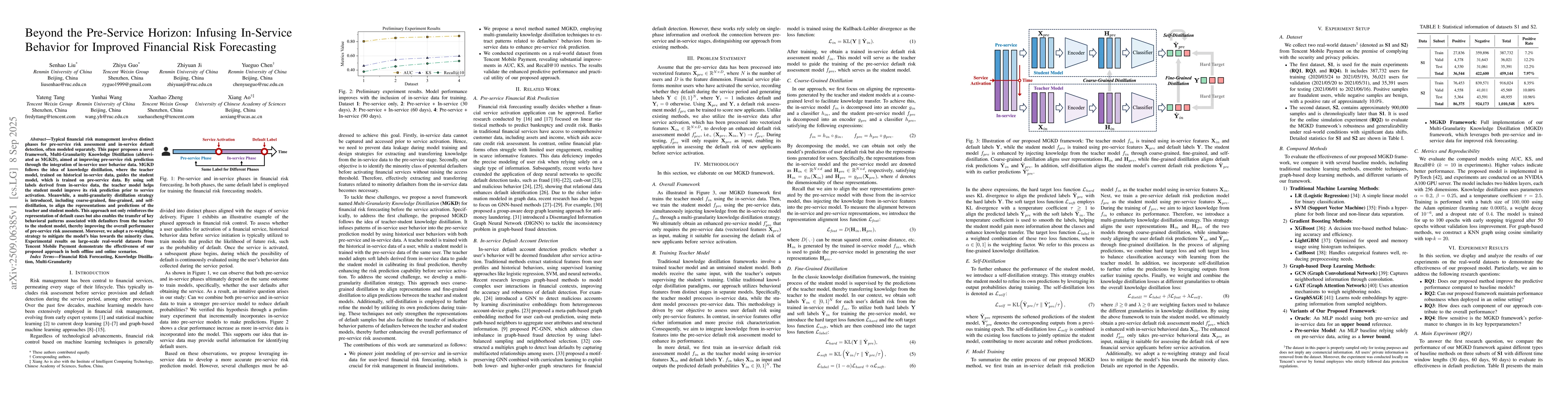

Beyond the Pre-Service Horizon: Infusing In-Service Behavior for Improved Financial Risk Forecasting

Typical financial risk management involves distinct phases for pre-service risk assessment and in-service default detection, often modeled separately. This paper proposes a novel framework, Multi-Gran...