Authors

Summary

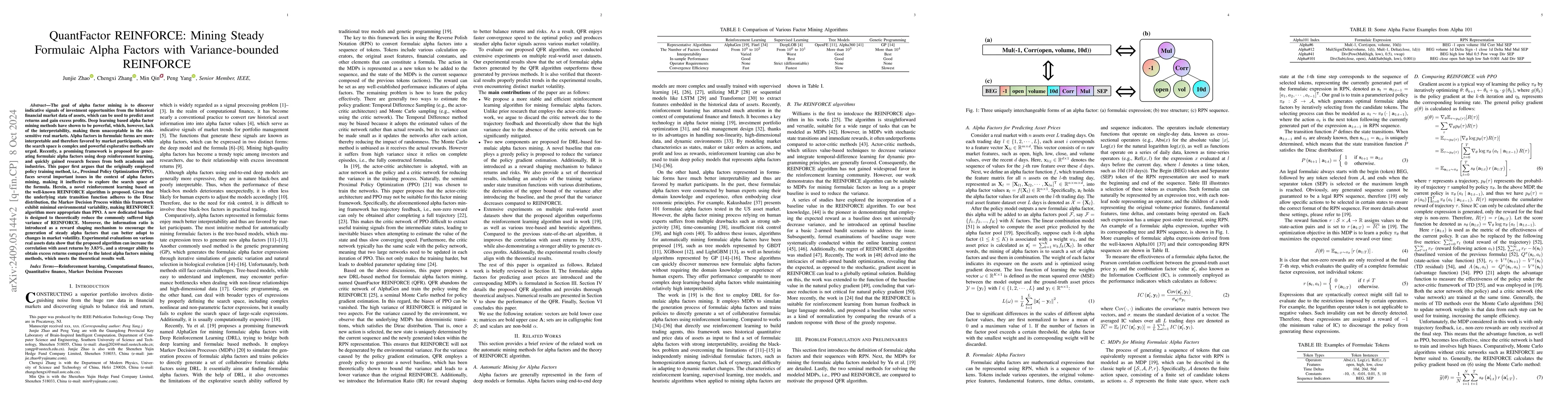

The goal of alpha factor mining is to discover indicative signals of investment opportunities from the historical financial market data of assets. Deep learning based alpha factor mining methods have shown to be powerful, which, however, lack of the interpretability, making them unacceptable in the risk-sensitive real markets. Alpha factors in formulaic forms are more interpretable and therefore favored by market participants, while the search space is complex and powerful explorative methods are urged. Recently, a promising framework is proposed for generating formulaic alpha factors using deep reinforcement learning, and quickly gained research focuses from both academia and industries. This paper first argues that the originally employed policy training method, i.e., Proximal Policy Optimization (PPO), faces several important issues in the context of alpha factors mining, making it ineffective to explore the search space of the formula. Herein, a novel reinforcement learning based on the well-known REINFORCE algorithm is proposed. Given that the underlying state transition function adheres to the Dirac distribution, the Markov Decision Process within this framework exhibit minimal environmental variability, making REINFORCE algorithm more appropriate than PPO. A new dedicated baseline is designed to theoretically reduce the commonly suffered high variance of REINFORCE. Moreover, the information ratio is introduced as a reward shaping mechanism to encourage the generation of steady alpha factors that can better adapt to changes in market volatility. Experimental evaluations on various real assets data show that the proposed algorithm can increase the correlation with asset returns by 3.83%, and a stronger ability to obtain excess returns compared to the latest alpha factors mining methods, which meets the theoretical results well.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning from Expert Factors: Trajectory-level Reward Shaping for Formulaic Alpha Mining

Peng Yang, Junjie Zhao, Chengxi Zhang et al.

Reinforce-Ada: An Adaptive Sampling Framework for Reinforce-Style LLM Training

Wei Xiong, Hanze Dong, Nan Jiang et al.

AlphaForge: A Framework to Mine and Dynamically Combine Formulaic Alpha Factors

Hao Shi, Cuicui Luo, Weili Song et al.

No citations found for this paper.

Comments (0)