Authors

Summary

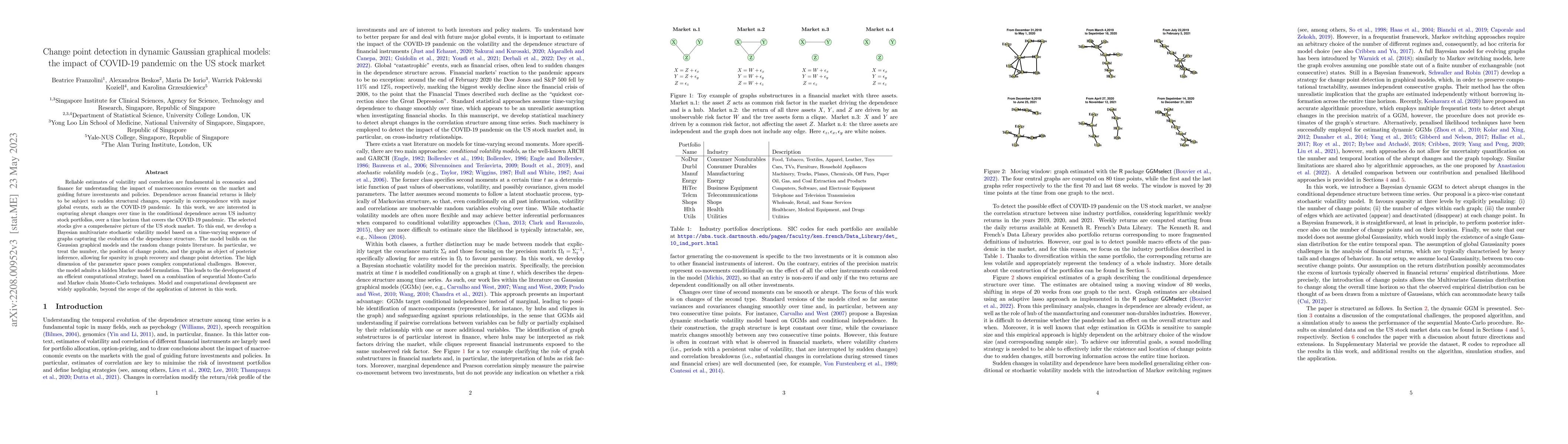

Reliable estimates of volatility and correlation are fundamental in economics and finance for understanding the impact of macroeconomics events on the market and guiding future investments and policies. Dependence across financial returns is likely to be subject to sudden structural changes, especially in correspondence with major global events, such as the COVID-19 pandemic. In this work, we are interested in capturing abrupt changes over time in the dependence across US industry stock portfolios, over a time horizon that covers the COVID-19 pandemic. The selected stocks give a comprehensive picture of the US stock market. To this end, we develop a Bayesian multivariate stochastic volatility model based on a time-varying sequence of graphs capturing the evolution of the dependence structure. The model builds on the Gaussian graphical models and the random change points literature. In particular, we treat the number, the position of change points, and the graphs as object of posterior inference, allowing for sparsity in graph recovery and change point detection. The high dimension of the parameter space poses complex computational challenges. However, the model admits a hidden Markov model formulation. This leads to the development of an efficient computational strategy, based on a combination of sequential Monte-Carlo and Markov chain Monte-Carlo techniques. Model and computational development are widely applicable, beyond the scope of the application of interest in this work.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting the Performance of US Stock Market Indices During COVID-19: RF vs LSTM

Ali Lashgari, Reza Nematirad, Amin Ahmadisharaf

No citations found for this paper.

Comments (0)