Summary

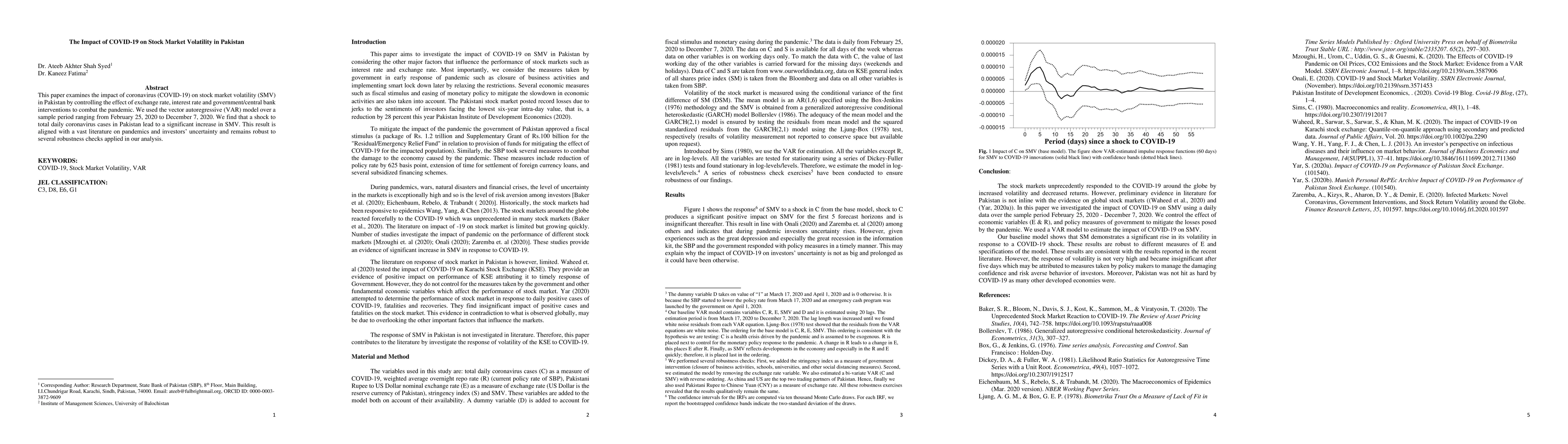

This paper examines the impact of coronavirus (COVID-19) on stock market volatility (SMV) in Pakistan by controlling the effect of exchange rate, interest rate and government/central bank interventions to combat the pandemic. We used the vector autoregressive (VAR) model over a sample period ranging from February 25, 2020 to December 7, 2020. We find that a shock to total daily coronavirus cases in Pakistan lead to a significant increase in SMV. This result is aligned with a vast literature on pandemics and investors uncertainty and remains robust to several robustness checks applied in our analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantifying the impact of COVID-19 on the US stock market: An analysis from multi-source information

| Title | Authors | Year | Actions |

|---|

Comments (0)