Authors

Summary

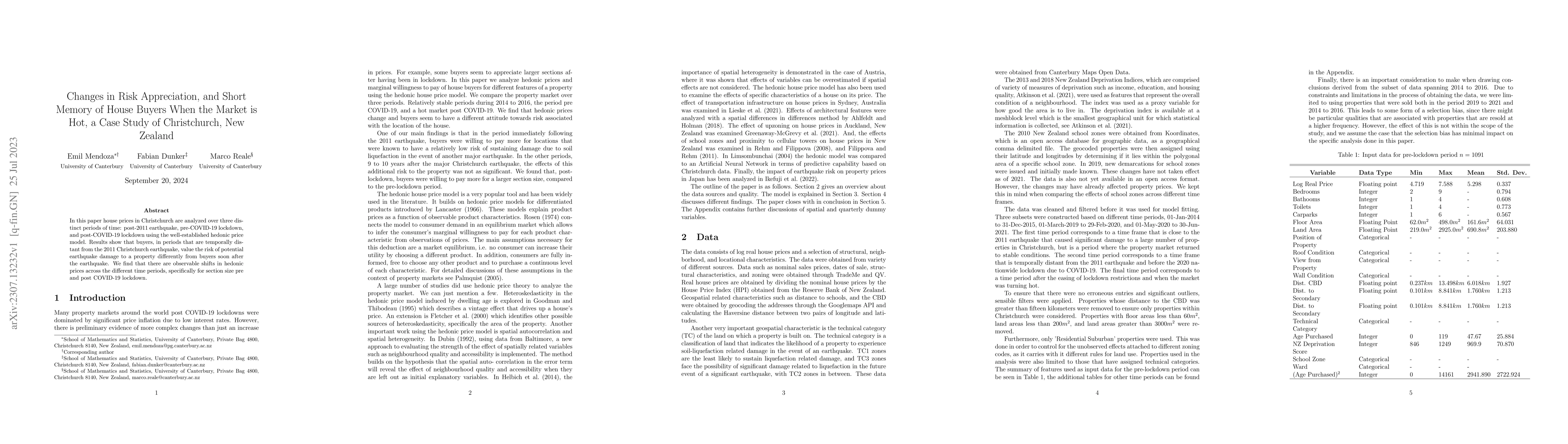

In this paper house prices in Christchurch are analyzed over three distinct periods of time: post-2011 earthquake, pre-COVID-19 lockdown, and post-COVID-19 lockdown using the well-established hedonic price model. Results show that buyers, in periods that are temporally distant from the 2011 Christchurch earthquake, value the risk of potential earthquake damage to a property differently from buyers soon after the earthquake. We find that there are observable shifts in hedonic prices across the different time periods, specifically for section size pre and post COVID-19 lockdown.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHeterogenous Mental Health Impacts of a Forced Relocation: The Red Zone in Christchurch (New Zealand).

Hoang, Thoa, Noy, Ilan, Van, Thinh Le

A Study of the New Zealand Mathematics Curriculum

Tanya Evans, Neil Morrow, Elizabeth Rata

Comparative Study of Long Short-Term Memory (LSTM) and Quantum Long Short-Term Memory (QLSTM): Prediction of Stock Market Movement

Tariq Mahmood, Ibtasam Ahmad, Malik Muhammad Zeeshan Ansar et al.

No citations found for this paper.

Comments (0)