Summary

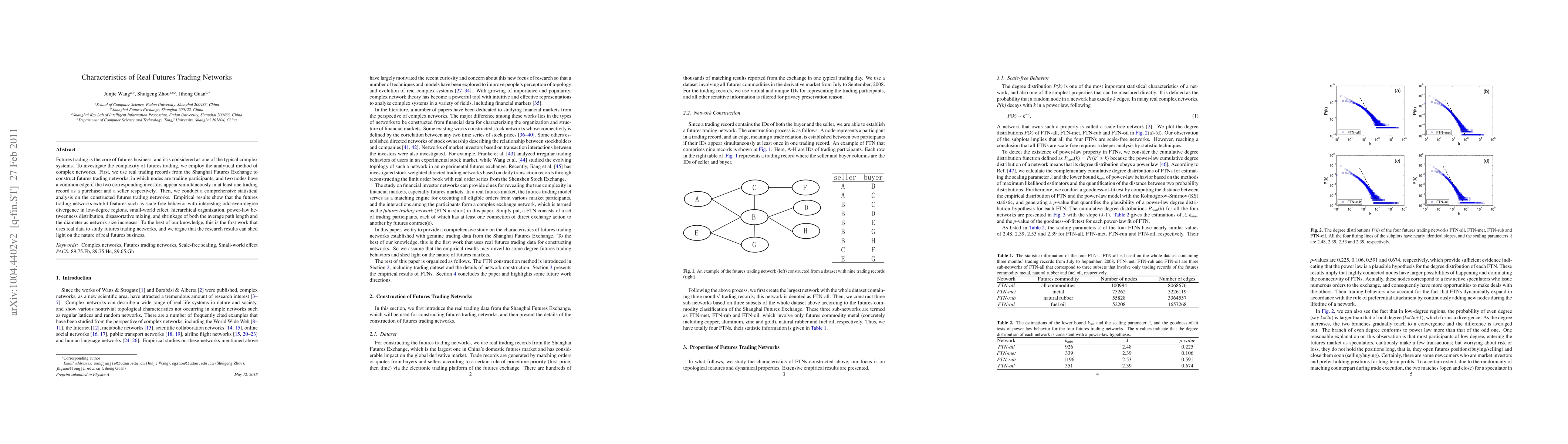

Futures trading is the core of futures business, and it is considered as one of the typical complex systems. To investigate the complexity of futures trading, we employ the analytical method of complex networks. First, we use real trading records from the Shanghai Futures Exchange to construct futures trading networks, in which nodes are trading participants, and two nodes have a common edge if the two corresponding investors appear simultaneously in at least one trading record as a purchaser and a seller respectively. Then, we conduct a comprehensive statistical analysis on the constructed futures trading networks. Empirical results show that the futures trading networks exhibit features such as scale-free behavior with interesting odd-even-degree divergence in low-degree regions, small-world effect, hierarchical organization, power-law betweenness distribution, disassortative mixing, and shrinkage of both the average path length and the diameter as network size increases. To the best of our knowledge, this is the first work that uses real data to study futures trading networks, and we argue that the research results can shed light on the nature of real futures business.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)