Summary

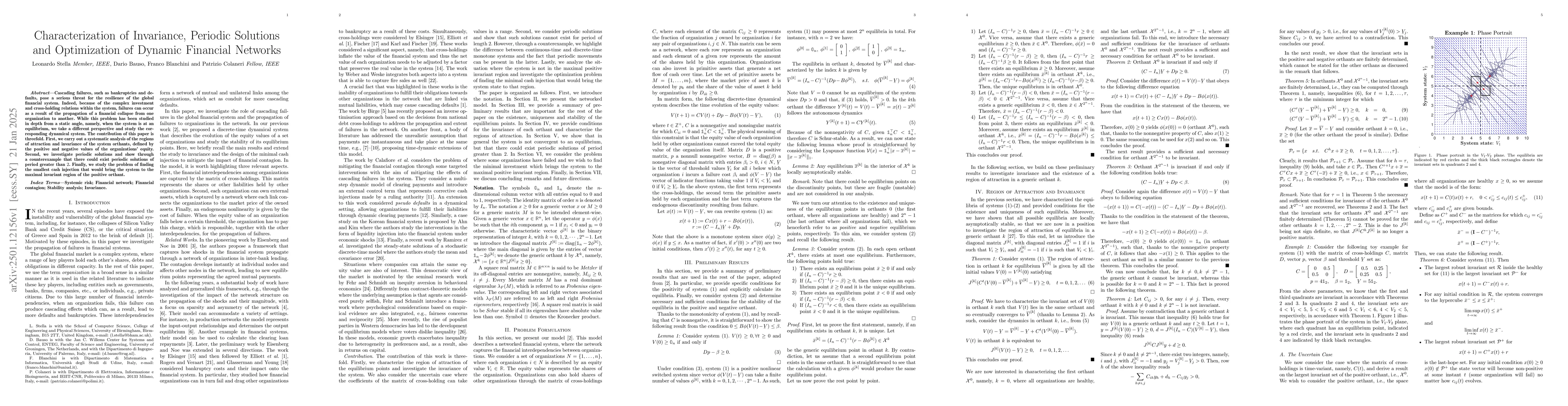

Cascading failures, such as bankruptcies and defaults, pose a serious threat for the resilience of the global financial system. Indeed, because of the complex investment and cross-holding relations within the system, failures can occur as a result of the propagation of a financial collapse from one organization to another. While this problem has been studied in depth from a static angle, namely, when the system is at an equilibrium, we take a different perspective and study the corresponding dynamical system. The contribution of this paper is threefold. First, we carry out a systematic analysis of the regions of attraction and invariance of the system orthants, defined by the positive and negative values of the organizations' equity. Second, we investigate periodic solutions and show through a counterexample that there could exist periodic solutions of period greater than 2. Finally, we study the problem of finding the smallest cash injection that would bring the system to the maximal invariant region of the positive orthant.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersClearing Payments in Dynamic Financial Networks

Anton V. Proskurnikov, Giuseppe C. Calafiore, Giulia Fracastoro

Dynamic Clearing and Contagion in Financial Networks

Zachary Feinstein, Tathagata Banerjee, Alex Bernstein

No citations found for this paper.

Comments (0)