Summary

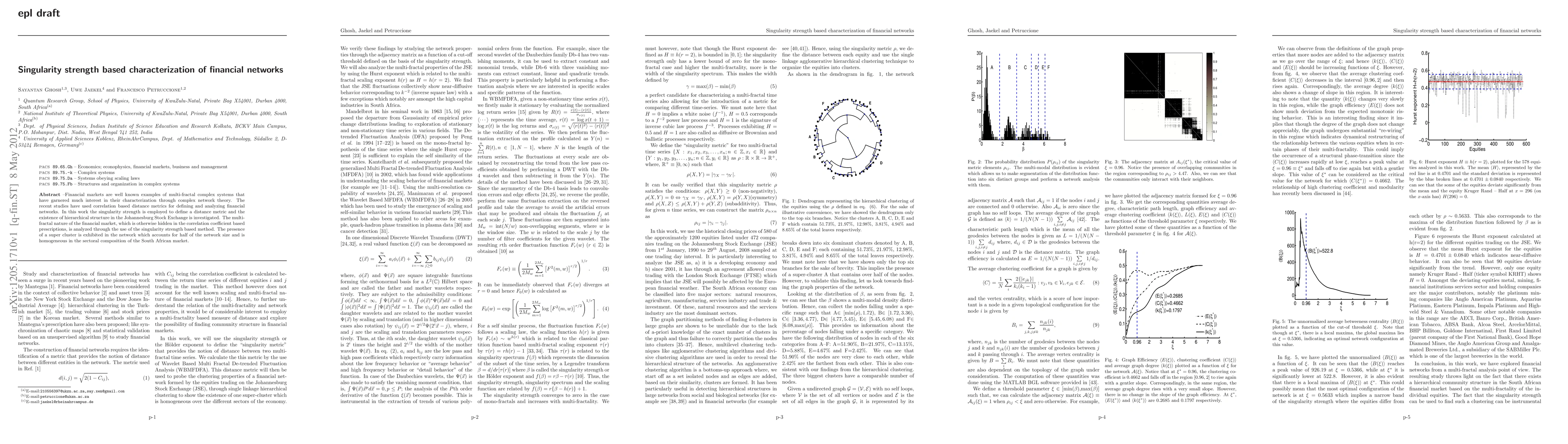

Financial markets are well known examples of multi-fractal complex systems that have garnered much interest in their characterization through complex network theory. The recent studies have used correlation based distance metrics for defining and analyzing financial networks. In this work the singularity strength is employed to define a distance metric and the existence of hierarchical structure in the Johannesburg Stock Exchange is investigated. The multi-fractal nature of the financial market, which is otherwise hidden in the correlation coefficient based prescriptions, is analyzed through the use of the singularity strength based method. The presence of a super cluster is exhibited in the network which accounts for half of the network size and is homogeneous in the sectoral composition of the South African market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)