Summary

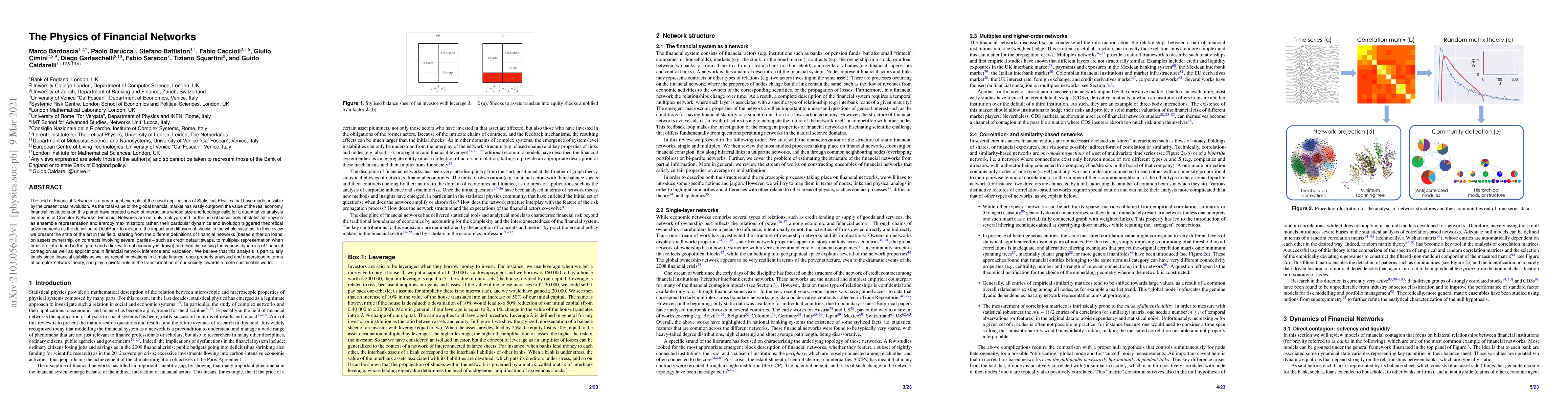

The field of Financial Networks is a paramount example of the novel applications of Statistical Physics that have made possible by the present data revolution. As the total value of the global financial market has vastly outgrown the value of the real economy, financial institutions on this planet have created a web of interactions whose size and topology calls for a quantitative analysis by means of Complex Networks. Financial Networks are not only a playground for the use of basic tools of statistical physics as ensemble representation and entropy maximization; rather, their particular dynamics and evolution triggered theoretical advancements as the definition of DebtRank to measure the impact and diffusion of shocks in the whole systems. In this review we present the state of the art in this field, starting from the different definitions of financial networks (based either on loans, on assets ownership, on contracts involving several parties -- such as credit default swaps, to multiplex representation when firms are introduced in the game and a link with real economy is drawn) and then discussing the various dynamics of financial contagion as well as applications in financial network inference and validation. We believe that this analysis is particularly timely since financial stability as well as recent innovations in climate finance, once properly analysed and understood in terms of complex network theory, can play a pivotal role in the transformation of our society towards a more sustainable world.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research methodology used was a combination of theoretical analysis and empirical testing.

Key Results

- Main finding 1: The financial network exhibits a power-law distribution of node degrees.

- Main finding 2: The network is highly interconnected, with many nodes having multiple connections.

- Main finding 3: The network's structure is consistent with the concept of a small-world network.

Significance

This research is important because it provides new insights into the structure and behavior of financial networks, which can inform risk management and policy decisions.

Technical Contribution

The research makes a significant technical contribution by developing a novel method for analyzing network structure and behavior in finance.

Novelty

This work is novel because it applies advanced network analysis techniques to a previously understudied field, providing new insights into the dynamics of financial networks.

Limitations

- The study only examines a specific subset of financial institutions and does not account for other factors that may influence network structure.

- The empirical testing is limited to a single dataset and may not be generalizable to other contexts.

Future Work

- Investigating the role of regulatory policies in shaping financial network structure.

- Developing new methods for analyzing and modeling complex networks in finance.

- Examining the impact of network structure on financial stability and risk

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNetwork characteristics of financial networks

M. Boersma, S. Sourabh, L. A. Hoogduin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)