Summary

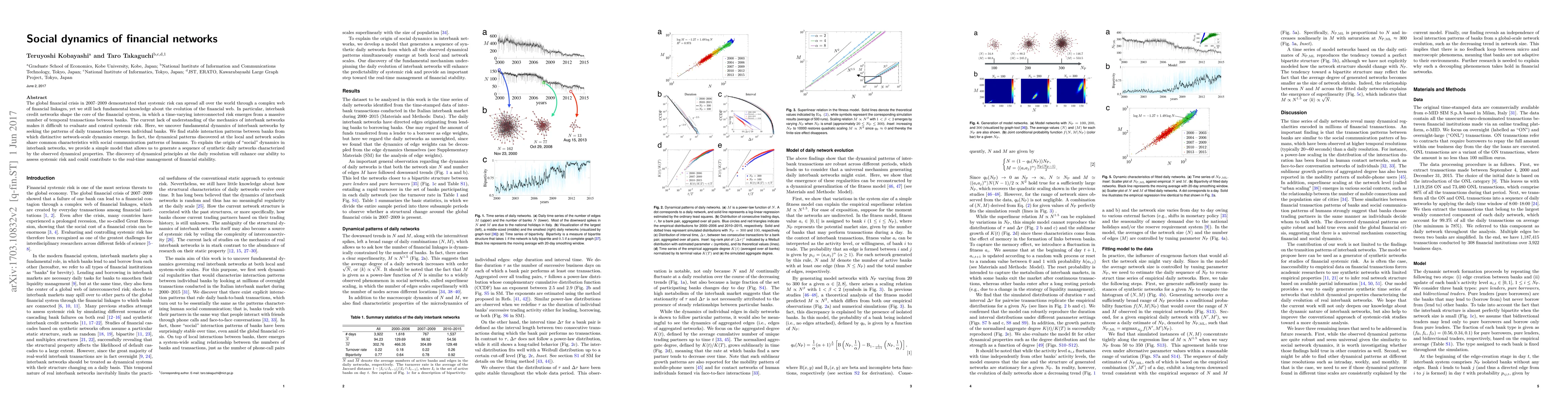

The global financial crisis in 2007-2009 demonstrated that systemic risk can spread all over the world through a complex web of financial linkages, yet we still lack fundamental knowledge about the evolution of the financial web. In particular, interbank credit networks shape the core of the financial system, in which a time-varying interconnected risk emerges from a massive number of temporal transactions between banks. The current lack of understanding of the mechanics of interbank networks makes it difficult to evaluate and control systemic risk. Here, we uncover fundamental dynamics of interbank networks by seeking the patterns of daily transactions between individual banks. We find stable interaction patterns between banks from which distinctive network-scale dynamics emerge. In fact, the dynamical patterns discovered at the local and network scales share common characteristics with social communication patterns of humans. To explain the origin of "social" dynamics in interbank networks, we provide a simple model that allows us to generate a sequence of synthetic daily networks characterized by the observed dynamical properties. The discovery of dynamical principles at the daily resolution will enhance our ability to assess systemic risk and could contribute to the real-time management of financial stability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)