Paolo Barucca

21 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Predicting public market behavior from private equity deals

We process private equity transactions to predict public market behavior with a logit model. Specifically, we estimate our model to predict quarterly returns for both the broad market and for indivi...

No-Arbitrage Deep Calibration for Volatility Smile and Skewness

Volatility smile and skewness are two key properties of option prices that are represented by the implied volatility (IV) surface. However, IV surface calibration through nonlinear interpolation is ...

Modelling Equity Transaction Networks as Bursty Processes

Trade executions for major stocks come in bursts of activity, which can be partly attributed to the presence of self- and mutual excitations endogenous to the system. In this paper, we study transac...

Deep Reinforcement Learning for Optimal Investment and Saving Strategy Selection in Heterogeneous Profiles: Intelligent Agents working towards retirement

The transition from defined benefit to defined contribution pension plans shifts the responsibility for saving toward retirement from governments and institutions to the individuals. Determining opt...

Variational Heteroscedastic Volatility Model

We propose Variational Heteroscedastic Volatility Model (VHVM) -- an end-to-end neural network architecture capable of modelling heteroscedastic behaviour in multivariate financial time series. VHVM...

Deep Recurrent Modelling of Granger Causality with Latent Confounding

Inferring causal relationships in observational time series data is an important task when interventions cannot be performed. Granger causality is a popular framework to infer potential causal mecha...

Neural Generalised AutoRegressive Conditional Heteroskedasticity

We propose Neural GARCH, a class of methods to model conditional heteroskedasticity in financial time series. Neural GARCH is a neural network adaptation of the GARCH 1,1 model in the univariate cas...

Structural importance and evolution: an application to financial transaction networks

A fundamental problem in the study of networks is the identification of important nodes. This is typically achieved using centrality metrics, which rank nodes in terms of their position in the netwo...

The Recurrent Reinforcement Learning Crypto Agent

We demonstrate a novel application of online transfer learning for a digital assets trading agent. This agent uses a powerful feature space representation in the form of an echo state network, the o...

Consensus formation on heterogeneous networks

Reaching consensus -- a macroscopic state where the system constituents display the same microscopic state -- is a necessity in multiple complex socio-technical and techno-economic systems: their co...

Reinforcement Learning for Systematic FX Trading

We explore online inductive transfer learning, with a feature representation transfer from a radial basis function network formed of Gaussian mixture model hidden processing units to a direct, recur...

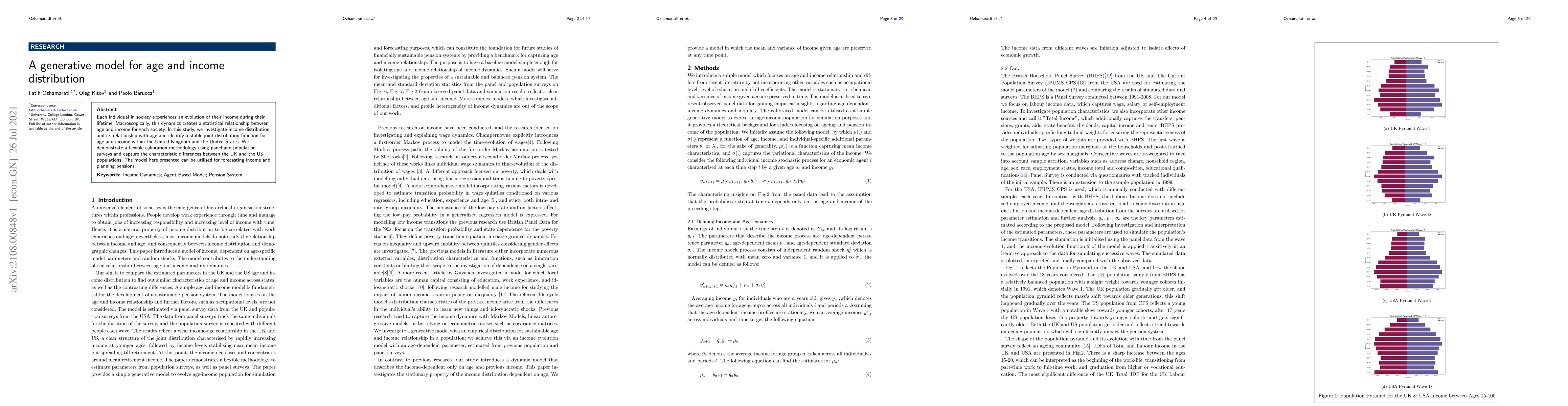

A generative model for age and income distribution

Each individual in society experiences an evolution of their income during their lifetime. Macroscopically, this dynamics creates a statistical relationship between age and income for each society. ...

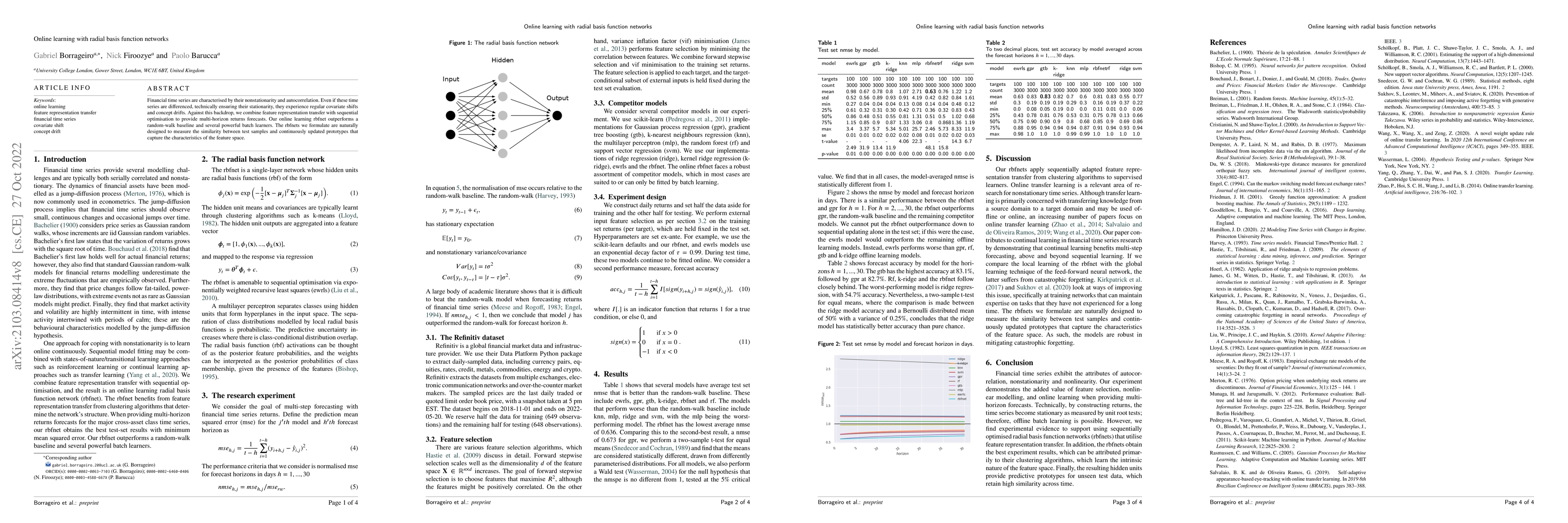

Online Learning with Radial Basis Function Networks

Financial time series are characterised by their nonstationarity and autocorrelation. Even if these time series are differenced, technically ensuring their stationarity, they experience regular cova...

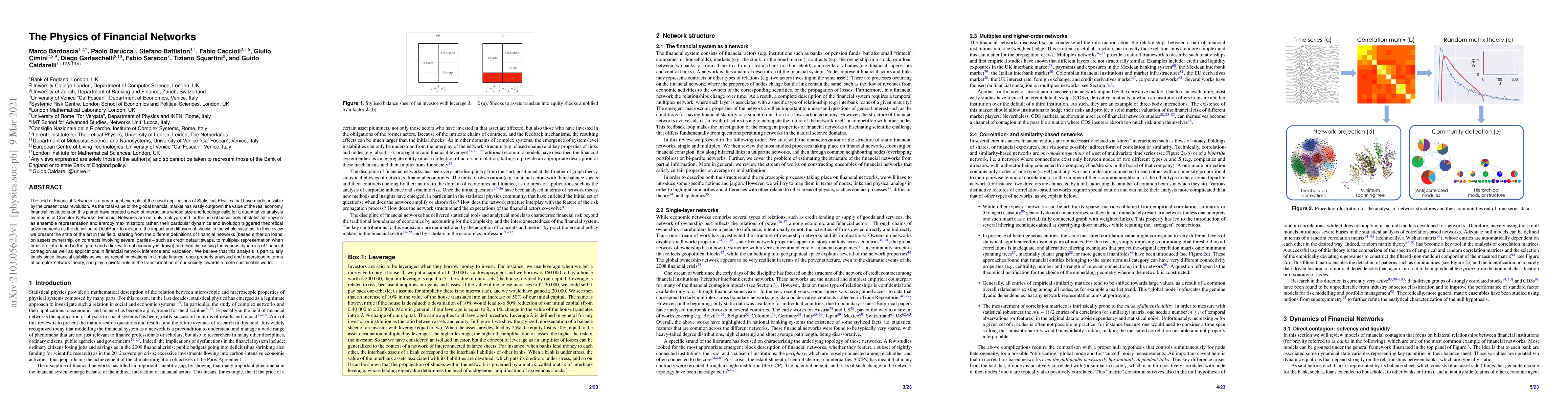

The Physics of Financial Networks

The field of Financial Networks is a paramount example of the novel applications of Statistical Physics that have made possible by the present data revolution. As the total value of the global finan...

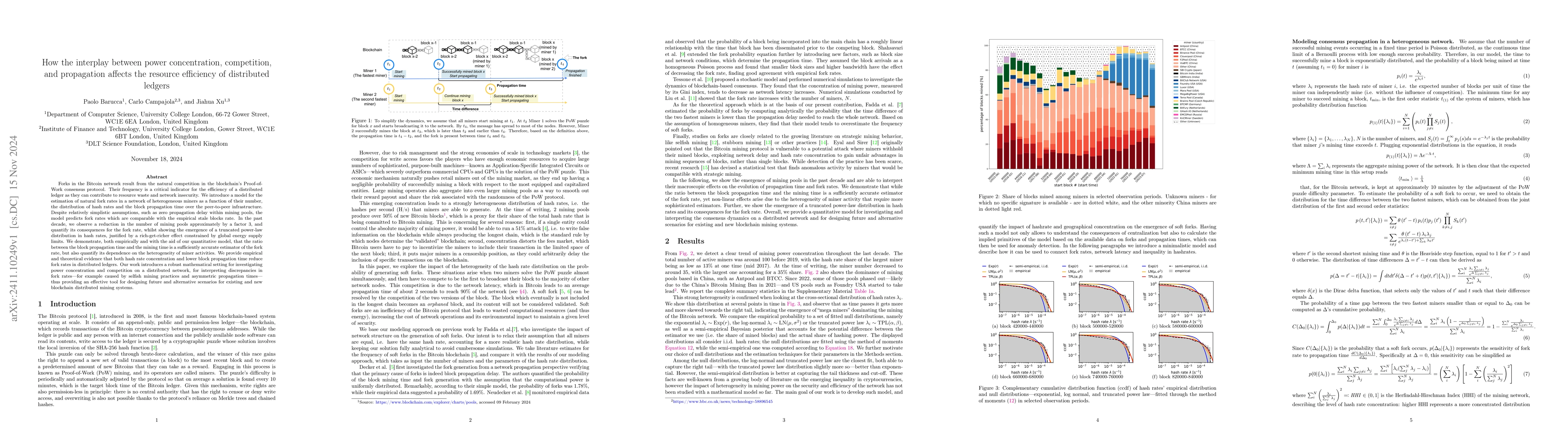

How the interplay between power concentration, competition, and propagation affects the resource efficiency of distributed ledgers

Forks in the Bitcoin network result from the natural competition in the blockchain's Proof-of-Work consensus protocol. Their frequency is a critical indicator for the efficiency of a distributed ledge...

Whack-a-mole Online Learning: Physics-Informed Neural Network for Intraday Implied Volatility Surface

Calibrating the time-dependent Implied Volatility Surface (IVS) using sparse market data is an essential challenge in computational finance, particularly for real-time applications. This task requires...

Random matrix ensemble for the covariance matrix of Ornstein-Uhlenbeck processes with heterogeneous temperatures

We introduce a random matrix model for the stationary covariance of multivariate Ornstein-Uhlenbeck processes with heterogeneous temperatures, where the covariance is constrained by the Sylvester-Lyap...

Granger Causality Detection with Kolmogorov-Arnold Networks

Discovering causal relationships in time series data is central in many scientific areas, ranging from economics to climate science. Granger causality is a powerful tool for causality detection. Howev...

How low-cost AI universal approximators reshape market efficiency

The efficient market hypothesis (EMH) famously stated that prices fully reflect the information available to traders. This critically depends on the transfer of information into prices through trading...

Parsimonious Hawkes Processes for temporal networks modelling

Temporal networks are characterised by interdependent link events between nodes, forming ordered sequences of links that may represent specific information flows in the system. Nevertheless, represent...

Maximum entropy temporal networks

Temporal networks consist of timestamped directed interactions rather than static links. These links may appear continuously in time, yet few studies have directly tackled the continuous-time modeling...