Summary

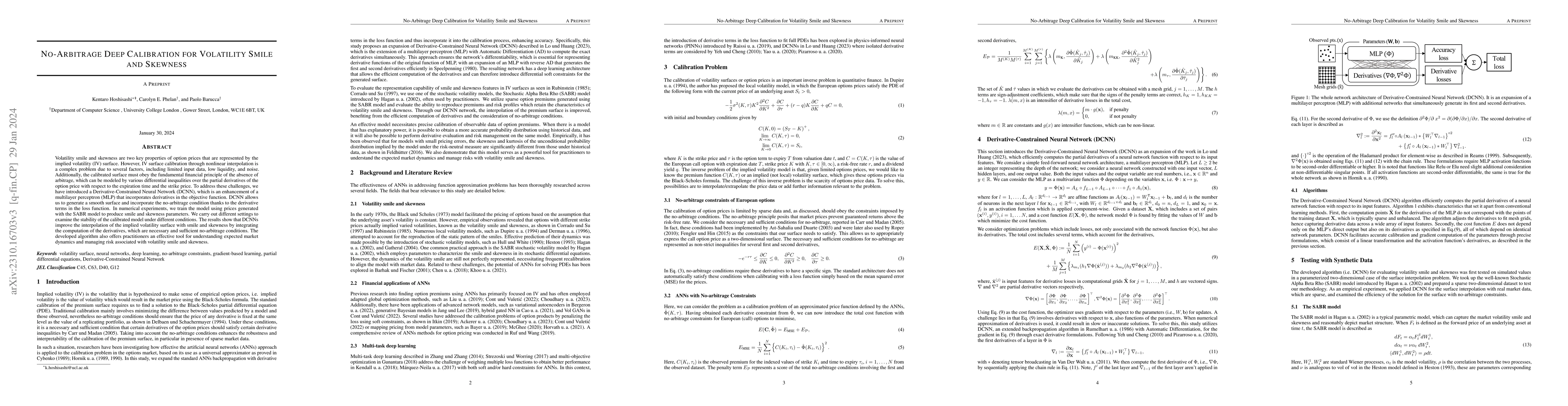

Volatility smile and skewness are two key properties of option prices that are represented by the implied volatility (IV) surface. However, IV surface calibration through nonlinear interpolation is a complex problem due to several factors, including limited input data, low liquidity, and noise. Additionally, the calibrated surface must obey the fundamental financial principle of the absence of arbitrage, which can be modeled by various differential inequalities over the partial derivatives of the option price with respect to the expiration time and the strike price. To address these challenges, we have introduced a Derivative-Constrained Neural Network (DCNN), which is an enhancement of a multilayer perceptron (MLP) that incorporates derivatives in the objective function. DCNN allows us to generate a smooth surface and incorporate the no-arbitrage condition thanks to the derivative terms in the loss function. In numerical experiments, we train the model using prices generated with the SABR model to produce smile and skewness parameters. We carry out different settings to examine the stability of the calibrated model under different conditions. The results show that DCNNs improve the interpolation of the implied volatility surface with smile and skewness by integrating the computation of the derivatives, which are necessary and sufficient no-arbitrage conditions. The developed algorithm also offers practitioners an effective tool for understanding expected market dynamics and managing risk associated with volatility smile and skewness.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)