Summary

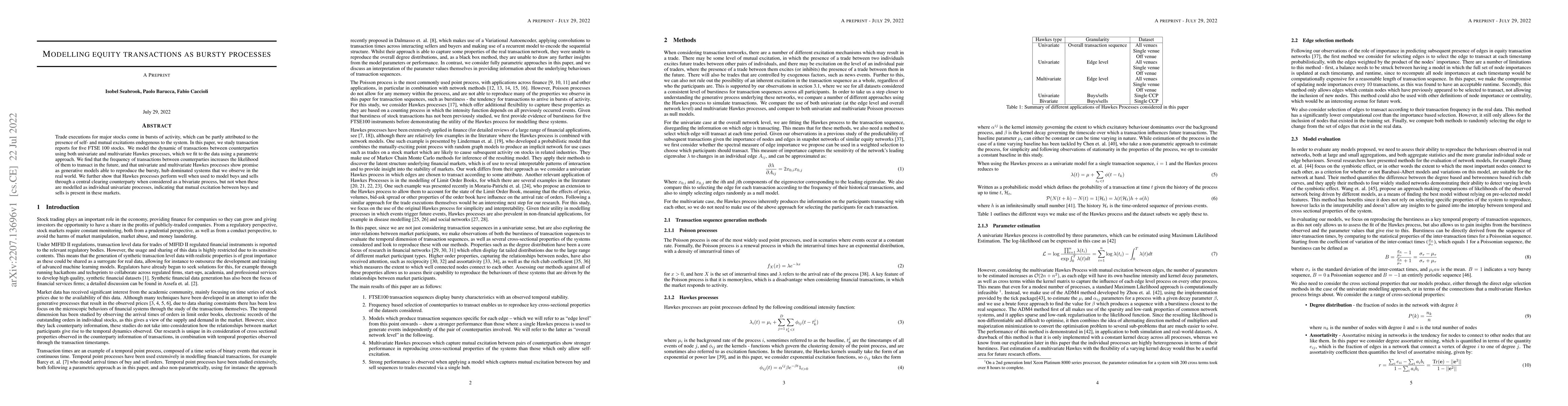

Trade executions for major stocks come in bursts of activity, which can be partly attributed to the presence of self- and mutual excitations endogenous to the system. In this paper, we study transaction reports for five FTSE 100 stocks. We model the dynamic of transactions between counterparties using both univariate and multivariate Hawkes processes, which we fit to the data using a parametric approach. We find that the frequency of transactions between counterparties increases the likelihood of them to transact in the future, and that univariate and multivariate Hawkes processes show promise as generative models able to reproduce the bursty, hub dominated systems that we observe in the real world. We further show that Hawkes processes perform well when used to model buys and sells through a central clearing counterparty when considered as a bivariate process, but not when these are modelled as individual univariate processes, indicating that mutual excitation between buys and sells is present in these markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)