Authors

Summary

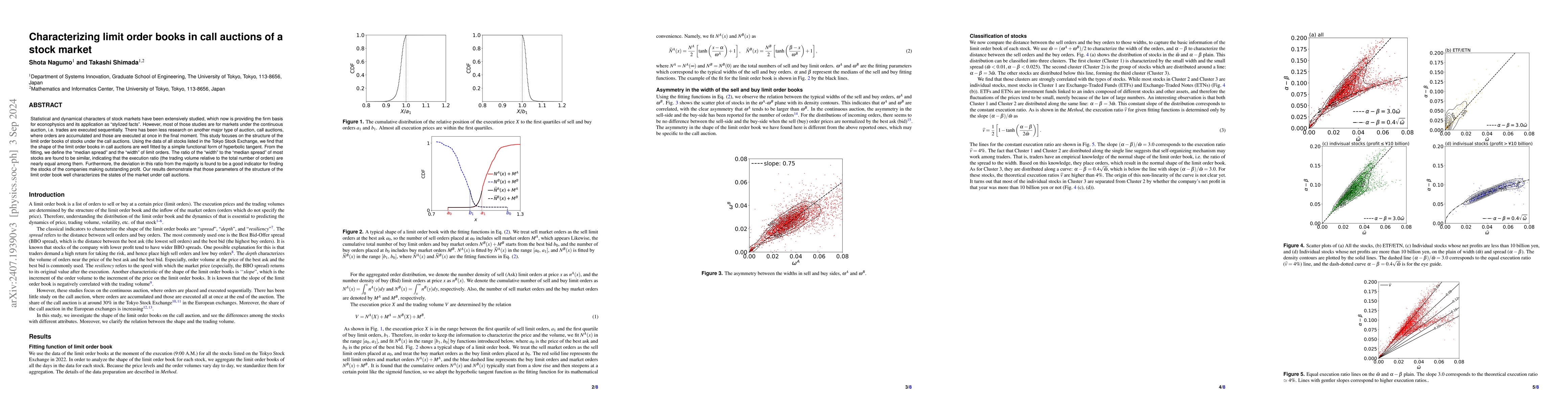

Statistical and dynamical characters of stock markets have been extensively studied, which now is providing the firm basis for econophysics and its application as ``stylized facts''. However, most of those studies are for markets under the continuous auction, i.e. trades are executed sequentially. There has been less research on another major type of auction, call auctions, where orders are accumulated and those are executed at once in the final moment. This study focuses on the structure of the limit order books of stocks under the call auctions. Using the data of all stocks listed in the Tokyo Stock Exchange, we find that the shape of the limit order books in call auctions are well fitted by a simple functional form of hyperbolic tangent. From the fitting, we define the ``median spread'' and the ``width'' of limit orders. The ratio of the ``width'' to the ``median spread'' of most stocks are found to be similar, indicating that the execution ratio (the trading volume relative to the total number of orders) are nearly equal among them. Furthermore, the deviation in this ratio from the majority is found to be a good indicator for finding the stocks of the companies making outstanding profit. Our results demonstrate that those parameters of the structure of the limit order book well characterizes the states of the market under call auctions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)