Summary

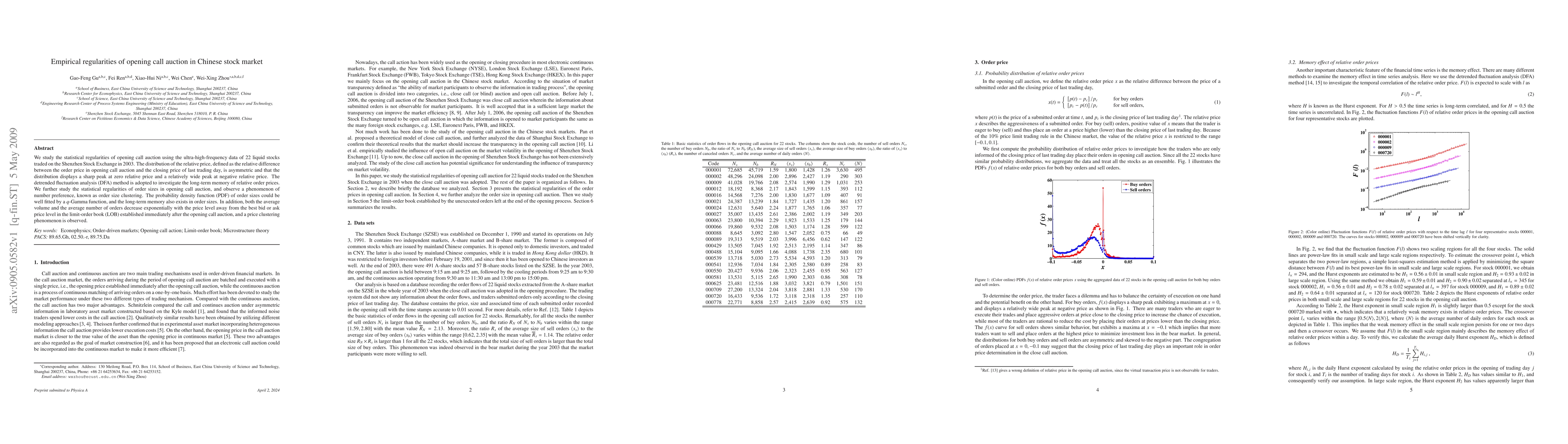

We study the statistical regularities of opening call auction using the ultra-high-frequency data of 22 liquid stocks traded on the Shenzhen Stock Exchange in 2003. The distribution of the relative price, defined as the relative difference between the order price in opening call auction and the closing price of last trading day, is asymmetric and that the distribution displays a sharp peak at zero relative price and a relatively wide peak at negative relative price. The detrended fluctuation analysis (DFA) method is adopted to investigate the long-term memory of relative order prices. We further study the statistical regularities of order sizes in opening call auction, and observe a phenomenon of number preference, known as order size clustering. The probability density function (PDF) of order sizes could be well fitted by a $q$-Gamma function, and the long-term memory also exists in order sizes. In addition, both the average volume and the average number of orders decrease exponentially with the price level away from the best bid or ask price level in the limit-order book (LOB) established immediately after the opening call auction, and a price clustering phenomenon is observed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

Characterizing limit order books in call auctions of a stock market

Takashi Shimada, Shota Nagumo

| Title | Authors | Year | Actions |

|---|

Comments (0)