Summary

The need for controlling and effectively managing credit risk has led financial institutions to excel in improving techniques designed for this purpose, resulting in the development of various quantitative models by financial institutions and consulting companies. Hence, the growing number of academic studies about credit scoring shows a variety of classification methods applied to discriminate good and bad borrowers. This paper, therefore, aims to present a systematic literature review relating theory and application of binary classification techniques for credit scoring financial analysis. The general results show the use and importance of the main techniques for credit rating, as well as some of the scientific paradigm changes throughout the years.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

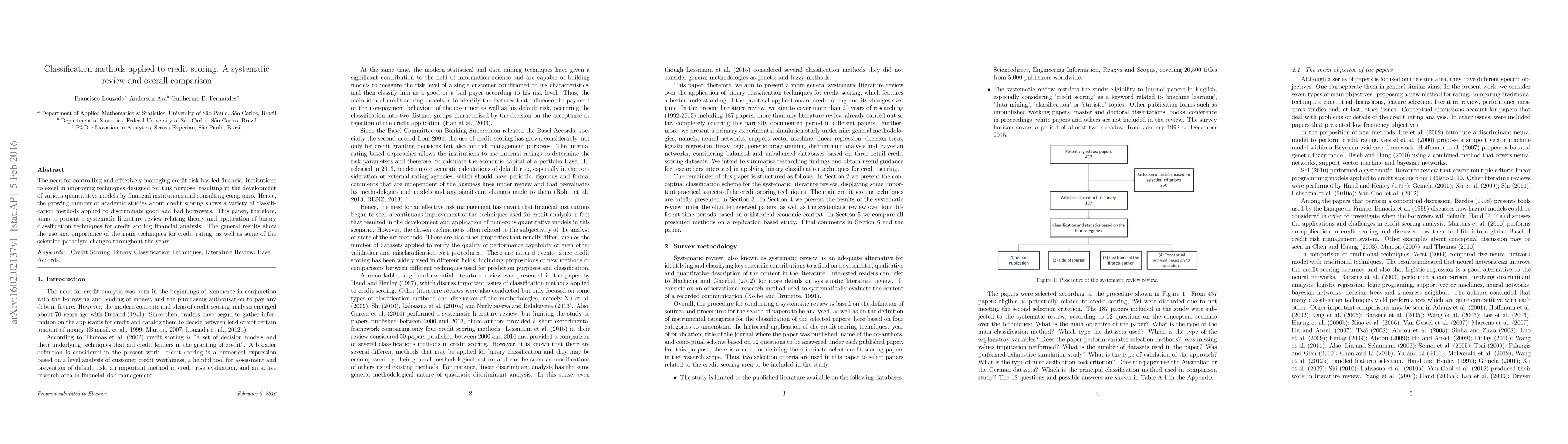

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Distributionally Robust Optimisation Approach to Fair Credit Scoring

Christophe Mues, Huan Yu, Pablo Casas

Interpretable LLMs for Credit Risk: A Systematic Review and Taxonomy

Muhammed Golec, Maha AlabdulJalil

| Title | Authors | Year | Actions |

|---|

Comments (0)