Authors

Summary

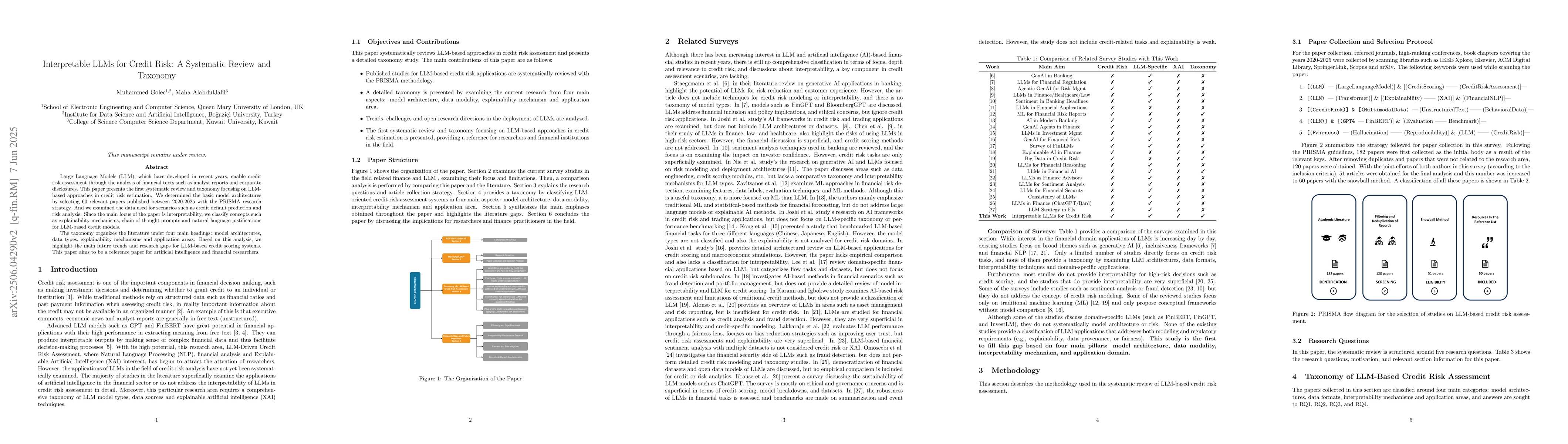

Large Language Models (LLM), which have developed in recent years, enable credit risk assessment through the analysis of financial texts such as analyst reports and corporate disclosures. This paper presents the first systematic review and taxonomy focusing on LLMbased approaches in credit risk estimation. We determined the basic model architectures by selecting 60 relevant papers published between 2020-2025 with the PRISMA research strategy. And we examined the data used for scenarios such as credit default prediction and risk analysis. Since the main focus of the paper is interpretability, we classify concepts such as explainability mechanisms, chain of thought prompts and natural language justifications for LLM-based credit models. The taxonomy organizes the literature under four main headings: model architectures, data types, explainability mechanisms and application areas. Based on this analysis, we highlight the main future trends and research gaps for LLM-based credit scoring systems. This paper aims to be a reference paper for artificial intelligence and financial researchers.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research employs a systematic review strategy using PRISMA to analyze 60 relevant papers on LLM-based credit risk estimation published between 2020-2025, focusing on model architectures, data types, explainability mechanisms, and application areas.

Key Results

- Establishes the first systematic review and taxonomy for interpretable LLMs in credit risk estimation.

- Classifies concepts like explainability mechanisms, chain of thought prompts, and natural language justifications for LLM-based credit models.

Significance

This research is crucial for AI and financial researchers as it aims to be a reference paper, highlighting future trends and research gaps in LLM-based credit scoring systems.

Technical Contribution

Develops a taxonomy organizing literature on LLM-based credit risk estimation under model architectures, data types, explainability mechanisms, and application areas.

Novelty

This paper is novel as it is the first systematic review and taxonomy focusing on interpretable LLMs for credit risk estimation, emphasizing explainability mechanisms crucial for financial applications.

Limitations

- The review is limited to papers published between 2020-2025, potentially missing earlier relevant work.

- Interpretability focus might overlook performance-based evaluations of LLM models in credit risk estimation.

Future Work

- Explore integration of advanced explainability techniques to enhance interpretability.

- Investigate the generalizability and robustness of LLM-based credit risk models across diverse financial contexts.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)