Authors

Summary

Accurately identifying the extremal dependence structure in multivariate heavy-tailed data is a fundamental yet challenging task, particularly in financial applications. Following a recently proposed bootstrap-based testing procedure, we apply the methodology to absolute log returns of U.S. S&P 500 and Chinese A-share stocks over a time period well before the U.S. election in 2024. The procedure reveals more isolated clustering of dependent assets in the U.S. economy compared with China which exhibits different characteristics and a more interconnected pattern of extremal dependence. Cross-market analysis identifies strong extremal linkages in sectors such as materials, consumer staples and consumer discretionary, highlighting the effectiveness of the testing procedure for large-scale empirical applications.

AI Key Findings

Generated Jun 08, 2025

Methodology

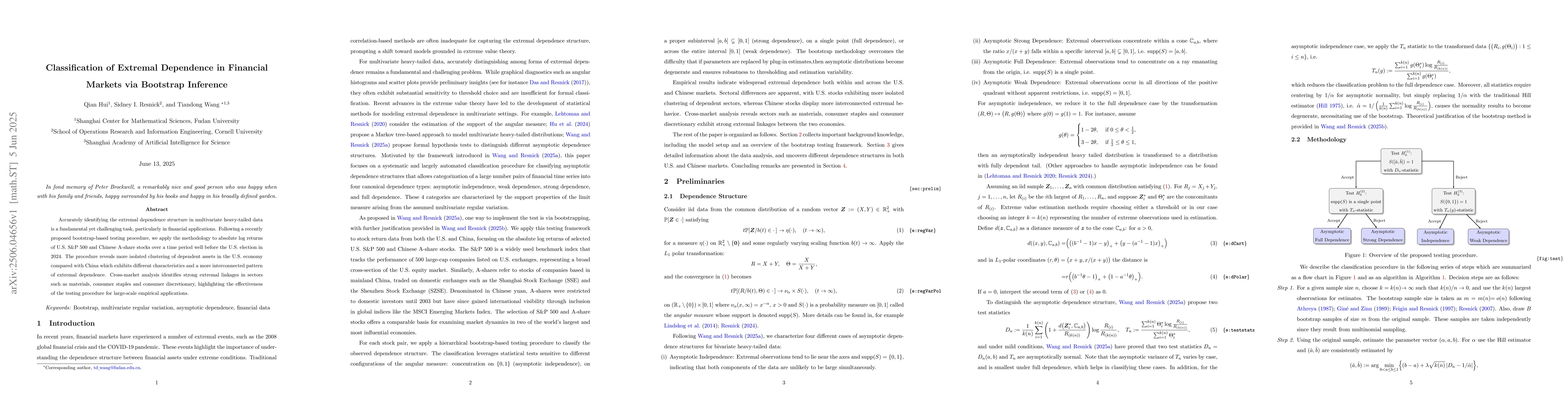

The research employs a bootstrap-based testing procedure to classify extremal dependence in multivariate heavy-tailed data, specifically focusing on absolute log returns of U.S. S&P 500 and Chinese A-share stocks.

Key Results

- The methodology identifies more isolated clustering of dependent assets in the U.S. economy compared to China, which shows a more interconnected pattern of extremal dependence.

- Cross-market analysis highlights strong extremal linkages in sectors like materials, consumer staples, and consumer discretionary.

- The testing procedure proves effective for large-scale empirical applications in financial markets.

Significance

This research is crucial for accurately identifying extremal dependence structures in financial markets, which is vital for risk management and investment strategies, with implications for both U.S. and Chinese markets.

Technical Contribution

The paper introduces and applies a novel bootstrap-based inference procedure for classifying extremal dependence in financial time series data, enhancing the understanding of tail dependencies in multivariate heavy-tailed distributions.

Novelty

This work stands out by applying advanced statistical techniques to real-world financial data, providing a robust method for distinguishing between different types of extremal dependence in diverse economies like the U.S. and China.

Limitations

- The study is limited to pre-2024 U.S. election data, so its findings might not reflect post-election market dynamics.

- The analysis is based on specific sectors and stock indices; broader market or sector coverage could enhance generalizability.

Future Work

- Further research could explore the applicability of this methodology to other global markets and diverse asset classes.

- Investigating the impact of unforeseen events (e.g., pandemics, geopolitical crises) on extremal dependence could be insightful.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtremal Dependence in Australian Electricity Markets

Lin Han, Ivor Cribben, Stefan Trueck

No citations found for this paper.

Comments (0)