Authors

Summary

We elucidate the problem of estimating large-dimensional covariance matrices in the presence of correlations between samples. To this end, we generalize the Marcenko-Pastur equation and the Ledoit-Peche shrinkage estimator using methods of random matrix theory and free probability. We develop an efficient algorithm that implements the corresponding analytic formulas, based on the Ledoit-Wolf kernel estimation technique. We also provide an associated open-source Python library, called "shrinkage", with a user-friendly API to assist in practical tasks of estimation of large covariance matrices. We present an example of its usage for synthetic data generated according to exponentially-decaying auto-correlations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

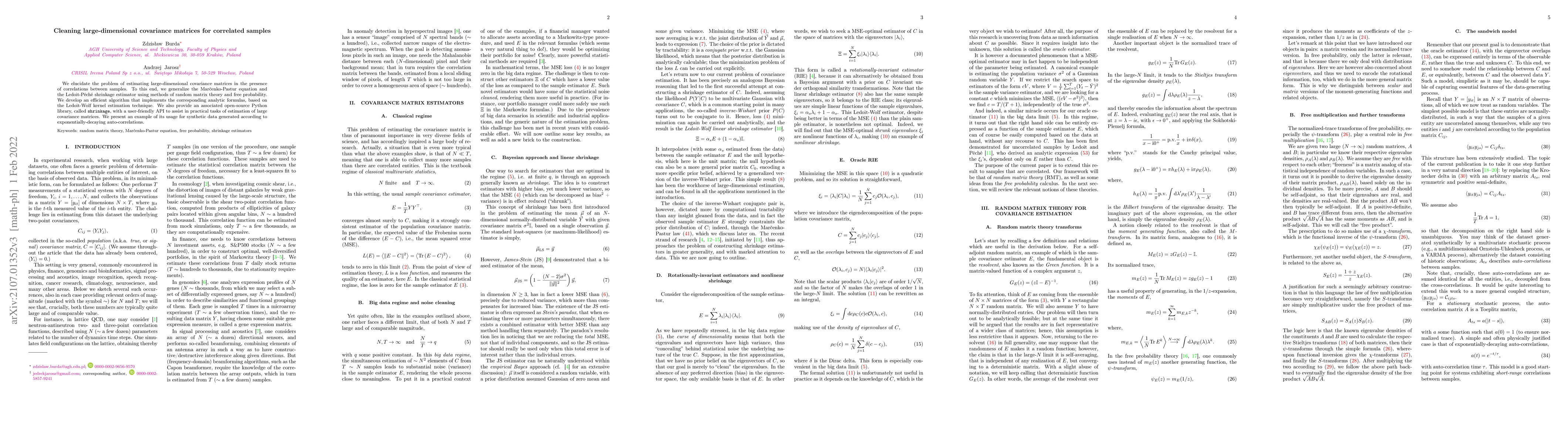

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)