Authors

Summary

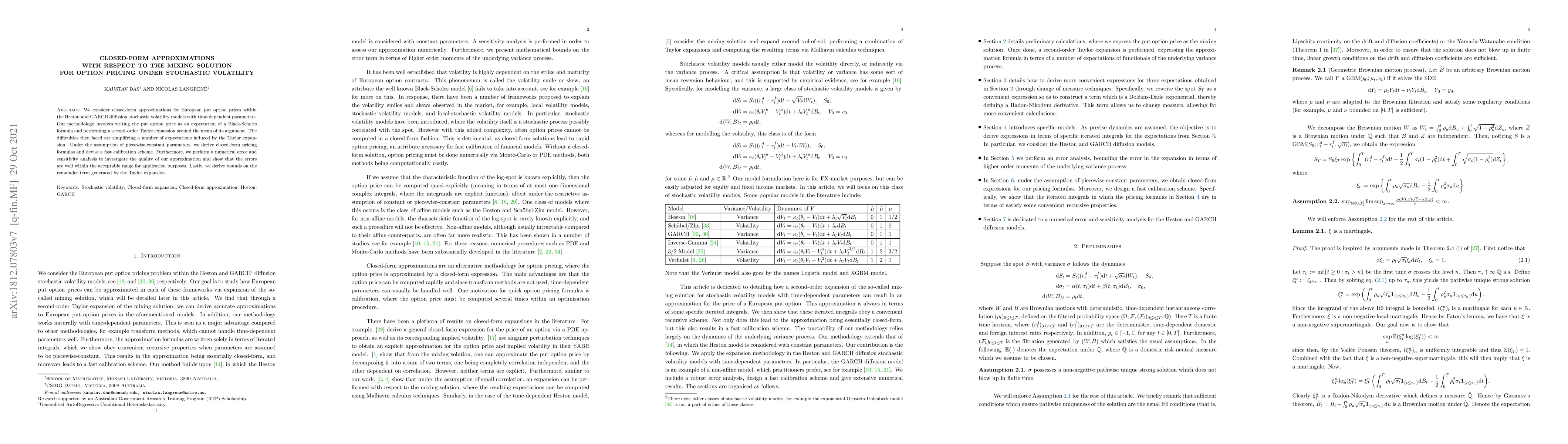

We consider closed-form approximations for European put option prices within the Heston and GARCH diffusion stochastic volatility models with time-dependent parameters. Our methodology involves writing the put option price as an expectation of a Black-Scholes formula and performing a second-order Taylor expansion around the mean of its argument. The difficulties then faced are simplifying a number of expectations induced by the Taylor expansion. Under the assumption of piecewise-constant parameters, we derive closed-form pricing formulas and devise a fast calibration scheme. Furthermore, we perform a numerical error and sensitivity analysis to investigate the quality of our approximation and show that the errors are well within the acceptable range for application purposes. Lastly, we derive bounds on the remainder term generated by the Taylor expansion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)