Authors

Summary

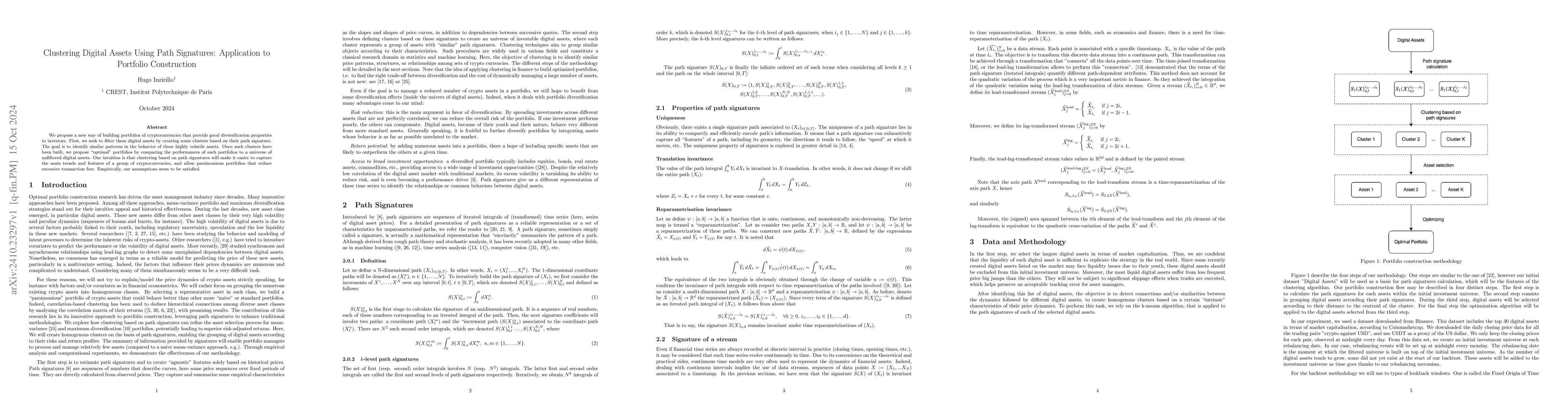

We propose a new way of building portfolios of cryptocurrencies that provide good diversification properties to investors. First, we seek to filter these digital assets by creating some clusters based on their path signature. The goal is to identify similar patterns in the behavior of these highly volatile assets. Once such clusters have been built, we propose "optimal" portfolios by comparing the performances of such portfolios to a universe of unfiltered digital assets. Our intuition is that clustering based on path signatures will make it easier to capture the main trends and features of a group of cryptocurrencies, and allow parsimonious portfolios that reduce excessive transaction fees. Empirically, our assumptions seem to be satisfied.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSimple and Effective Portfolio Construction with Crypto Assets

Stephen Boyd, Kasper Johansson

Optimizing Portfolio Management and Risk Assessment in Digital Assets Using Deep Learning for Predictive Analysis

Le Yang, Qishuo Cheng, Jiajian Zheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)