Summary

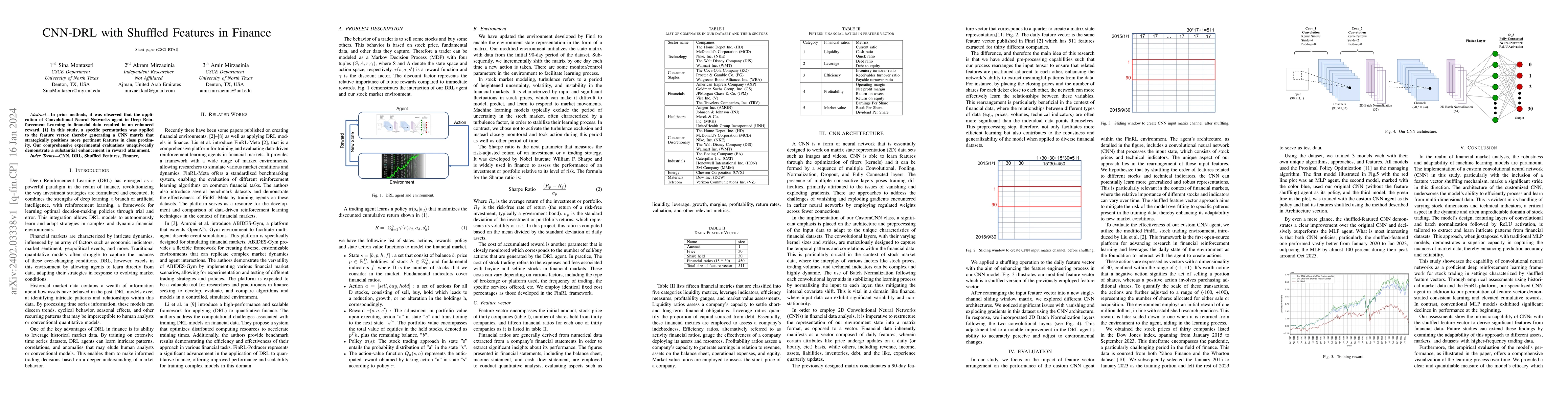

In prior methods, it was observed that the application of Convolutional Neural Networks agent in Deep Reinforcement Learning to financial data resulted in an enhanced reward. In this study, a specific permutation was applied to the feature vector, thereby generating a CNN matrix that strategically positions more pertinent features in close proximity. Our comprehensive experimental evaluations unequivocally demonstrate a substantial enhancement in reward attainment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCNN-DRL for Scalable Actions in Finance

Akram Mirzaeinia, Haseebullah Jumakhan, Amir Mirzaeinia et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)