Summary

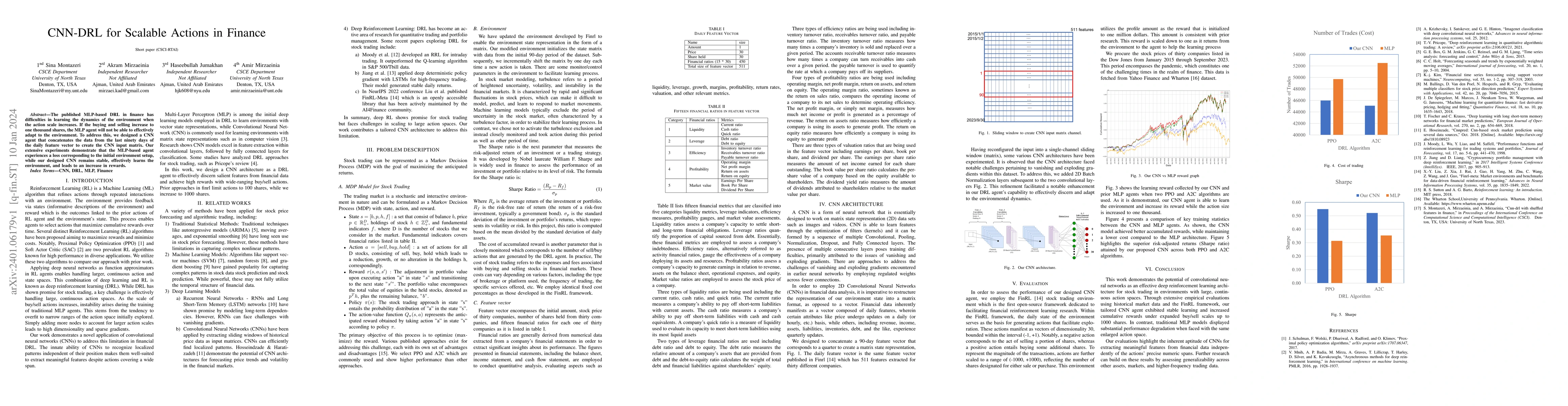

The published MLP-based DRL in finance has difficulties in learning the dynamics of the environment when the action scale increases. If the buying and selling increase to one thousand shares, the MLP agent will not be able to effectively adapt to the environment. To address this, we designed a CNN agent that concatenates the data from the last ninety days of the daily feature vector to create the CNN input matrix. Our extensive experiments demonstrate that the MLP-based agent experiences a loss corresponding to the initial environment setup, while our designed CNN remains stable, effectively learns the environment, and leads to an increase in rewards.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCNN-DRL with Shuffled Features in Finance

Akram Mirzaeinia, Amir Mirzaeinia, Sina Montazeri

Structure-Enhanced DRL for Optimal Transmission Scheduling

Yonghui Li, Branka Vucetic, Daniel E. Quevedo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)