Summary

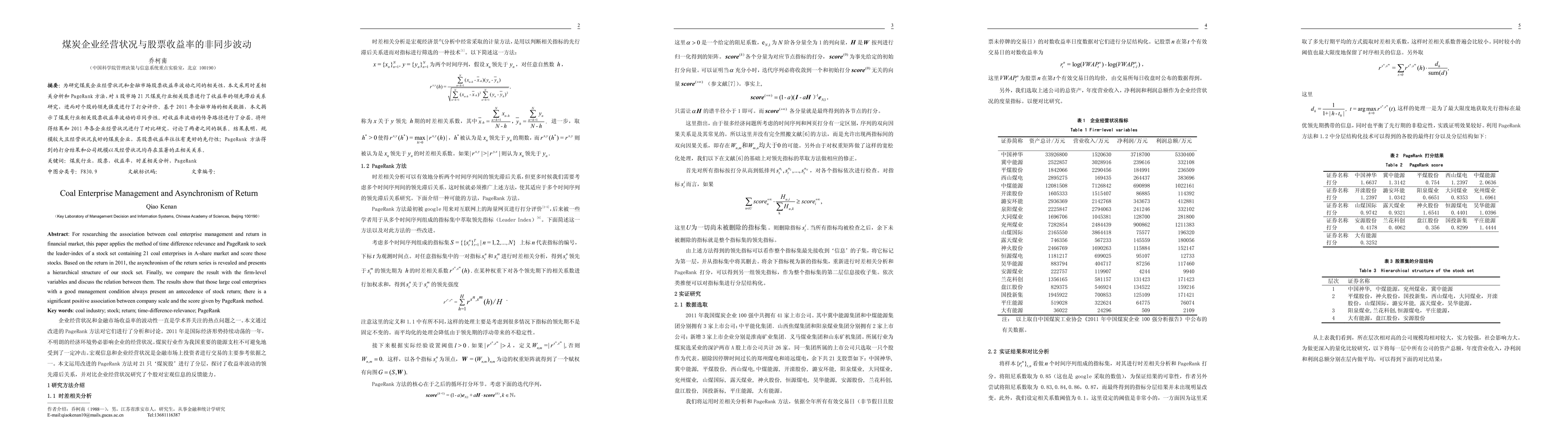

For researching the association between coal enterprise management and return in financial market, this paper applies the method of time difference relevance and PageRank method to seek the leader-index of a stock set containing 21 coal enterprises in A-share market and score those stocks. Based on the return in 2011, the asynchronism of the return series is revealed and presents a hierarchical structure of our stock set. Finally, we compare the result with the firm-level variables and discuss the relation between them. The results show that those large coal enterprises with a good management condition always present an antecedence of stock return; there is a significant positive association between company scale and the score given by PageRank method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExamination of coal combustion management sites for microbiological and chemical signatures of groundwater impacts.

Bagwell, Christopher E, Rodríguez-Ramos, Josué A, Hoyle, Sabrina et al.

No citations found for this paper.

Comments (0)