Summary

In this paper we analyze an extension of the Jeanblanc and Valchev (2005) model by considering a short-term uncertainty model with two noises. It is a combination of the ideas of Duffie and Lando (2001) and Jeanblanc and Valchev (2005): share quotations of the firm are available at the financial market, and these can be seen as noisy information about the fundamental value, or the firm's asset, from which a low level produces the credit event. We assume there are also reports of the firm, release times, where this short-term uncertainty disappears. This credit event model is used to describe conversion and default in a CoCo bond.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

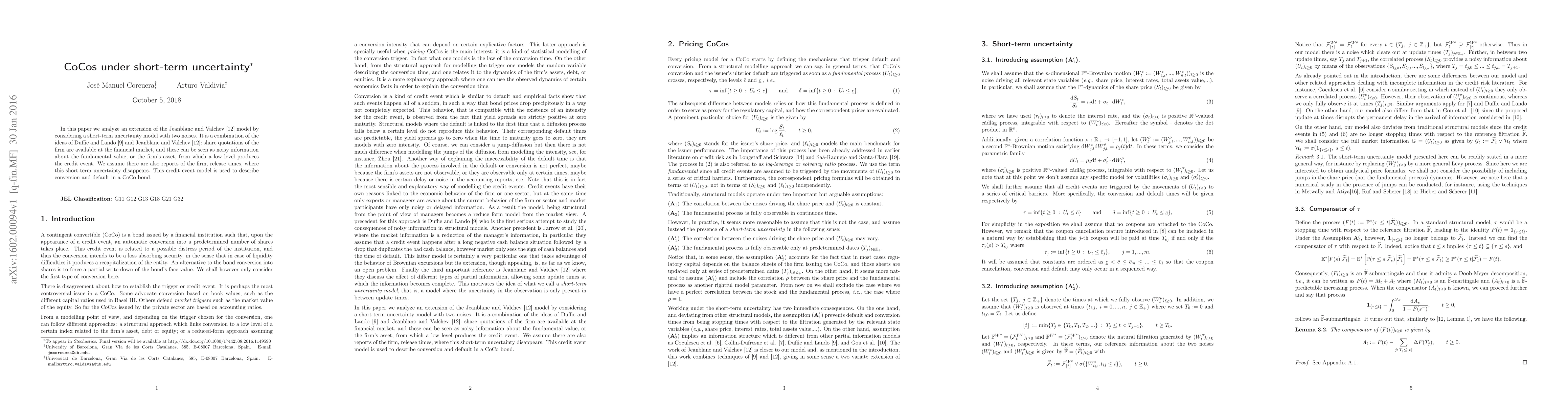

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn introduction to optimization under uncertainty -- A short survey

Keivan Shariatmadar, Kaizheng Wang, David Moens et al.

Accounting Noise and the Pricing of CoCos

Peter Spreij, Mike Derksen, Sweder van Wijnbergen

| Title | Authors | Year | Actions |

|---|

Comments (0)