Summary

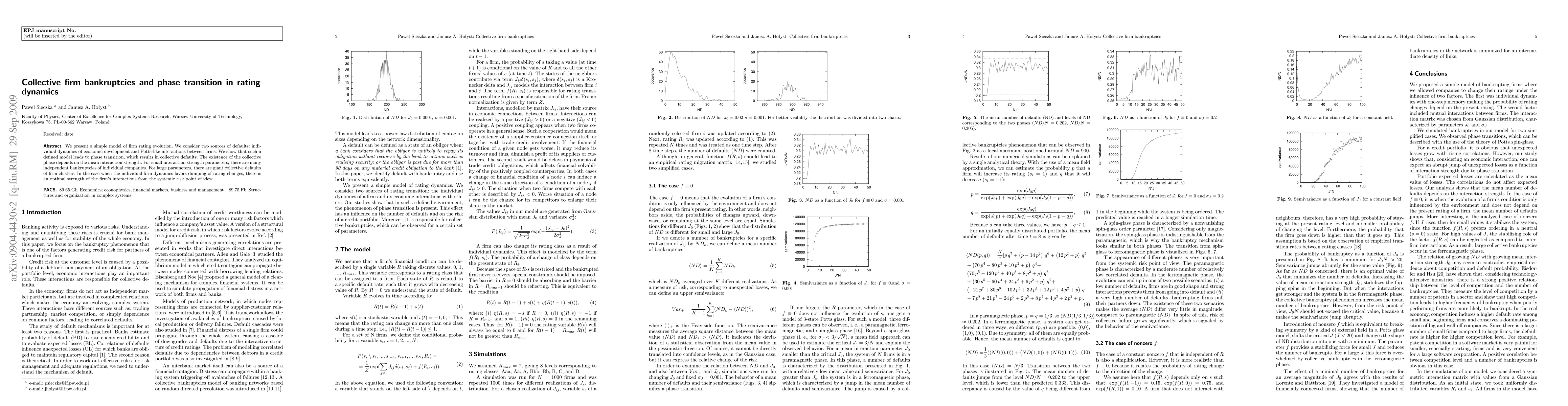

We present a simple model of firm rating evolution. We consider two sources of defaults: individual dynamics of economic development and Potts-like interactions between firms. We show that such a defined model leads to phase transition, which results in collective defaults. The existence of the collective phase depends on the mean interaction strength. For small interaction strength parameters, there are many independent bankruptcies of individual companies. For large parameters, there are giant collective defaults of firm clusters. In the case when the individual firm dynamics favors dumping of rating changes, there is an optimal strength of the firm's interactions from the systemic risk point of view.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSelf-organized criticality in a model of collective bank bankruptcies

Janusz A. Holyst, Agata Aleksiejuk, Gueorgi Kossinets

A Descriptive Method of Firm Size Transition Dynamics Using Markov Chain

Boyang You, Kerry Papps

| Title | Authors | Year | Actions |

|---|

Comments (0)