Authors

Summary

Users bid in a transaction fee mechanism (TFM) to get their transactions included and confirmed by a blockchain protocol. Roughgarden (EC'21) initiated the formal treatment of TFMs and proposed three requirements: user incentive compatibility (UIC), miner incentive compatibility (MIC), and a form of collusion-resilience called OCA-proofness. Ethereum's EIP-1559 mechanism satisfies all three properties simultaneously when there is no contention between transactions, but loses the UIC property when there are too many eligible transactions to fit in a single block. Chung and Shi (SODA'23) considered an alternative notion of collusion-resilience, called c-side-contract-proofness (c-SCP), and showed that, when there is contention between transactions, no TFM can satisfy UIC, MIC, and c-SCP for any c at least 1. OCA-proofness asserts that the users and a miner should not be able to "steal from the protocol." On the other hand, the c-SCP condition requires that a coalition of a miner and a subset of users should not be able to profit through strategic deviations (whether at the expense of the protocol or of the users outside the coalition). Our main result is the first proof that, when there is contention between transactions, no (possibly randomized) TFM in which users are expected to bid truthfully satisfies UIC, MIC, and OCA-proofness. This result resolves the main open question in Roughgarden (EC'21). We also suggest several relaxations of the basic model that allow our impossibility result to be circumvented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

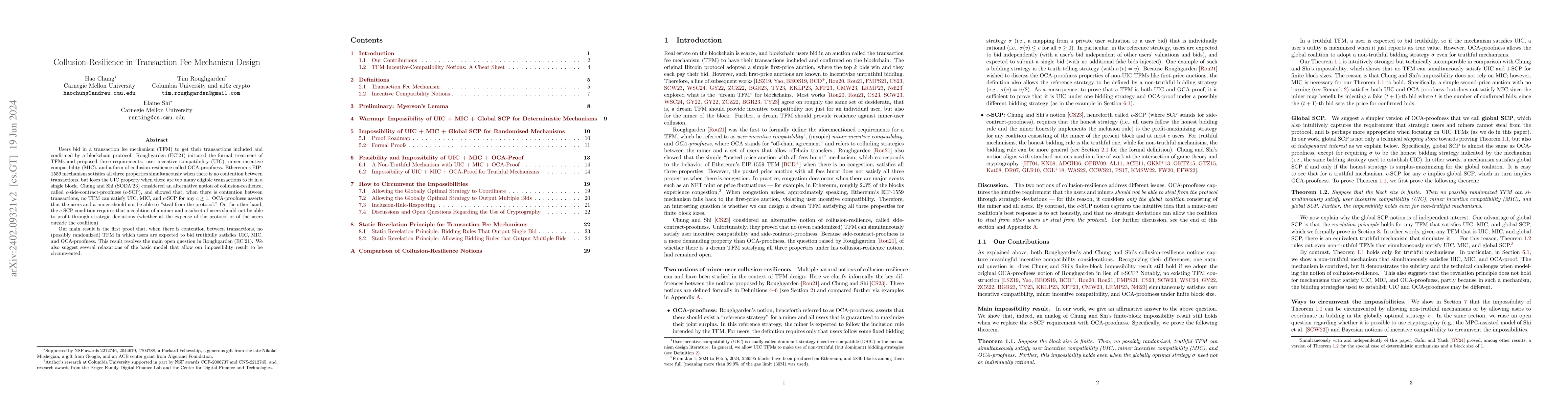

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Mechanism Design for Blockchain Transaction Fee Allocation

Xi Chen, David Simchi-Levi, Yuan Zhou et al.

Maximizing Miner Revenue in Transaction Fee Mechanism Design

Hao Chung, Elaine Shi, Ke Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)