Summary

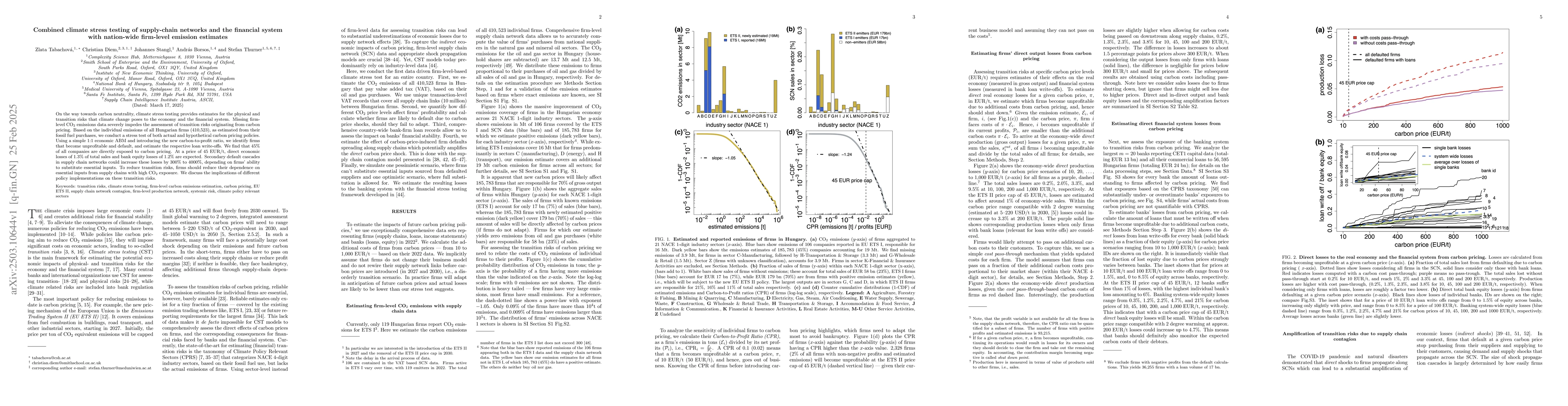

On the way towards carbon neutrality, climate stress testing provides estimates for the physical and transition risks that climate change poses to the economy and the financial system. Missing firm-level CO2 emissions data severely impedes the assessment of transition risks originating from carbon pricing. Based on the individual emissions of all Hungarian firms (410,523), as estimated from their fossil fuel purchases, we conduct a stress test of both actual and hypothetical carbon pricing policies. Using a simple 1:1 economic ABM and introducing the new carbon-to-profit ratio, we identify firms that become unprofitable and default, and estimate the respective loan write-offs. We find that 45% of all companies are directly exposed to carbon pricing. At a price of 45 EUR/t, direct economic losses of 1.3% of total sales and bank equity losses of 1.2% are expected. Secondary default cascades in supply chain networks could increase these losses by 300% to 4000%, depending on firms' ability to substitute essential inputs. To reduce transition risks, firms should reduce their dependence on essential inputs from supply chains with high CO2 exposure. We discuss the implications of different policy implementations on these transition risks.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research employs a firm-level emission estimation method using supply chain data to stress test supply-chain networks and the financial system under various carbon pricing scenarios. It introduces the carbon-to-profit ratio to identify unprofitable firms and estimate loan write-offs.

Key Results

- 45% of firms are directly exposed to carbon pricing.

- At a carbon price of 45 EUR/t, direct economic losses are 1.3% of total sales, and bank equity losses are 1.2%.

- Secondary default cascades in supply chains can increase losses by 300% to 4000%.

- Firms should reduce dependence on high CO2 exposure supply chains to mitigate transition risks.

- Different policy implementations have varying impacts on transition risks.

Significance

This study provides crucial insights for policymakers and financial institutions by quantifying transition risks from climate stress testing, thereby aiding in the transition towards carbon neutrality.

Technical Contribution

The paper introduces a simple agent-based model (ABM) to assess transition risks and the carbon-to-profit ratio to identify unprofitable firms under carbon pricing policies.

Novelty

The research combines firm-level emission estimates with supply chain network analysis and financial system stress testing, offering a novel approach to quantifying transition risks from climate change.

Limitations

- Missing firm-level CO2 emissions data hampers the assessment of transition risks.

- The model assumes non-negative net profits, which may not hold for all firms in the dataset.

- It does not account for potential measures such as installment postponements or firm restructuring in case of financial difficulties.

Future Work

- Investigate the implications of different policy implementations on transition risks in more detail.

- Explore the impact of additional climate-related factors not currently included in the model.

- Expand the analysis to include more countries or broader geographical regions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA data-driven econo-financial stress-testing framework to estimate the effect of supply chain networks on financial systemic risk

Stefan Thurner, András Borsos, Christian Diem et al.

Inferring firm-level supply chain networks with realistic systemic risk from industry sector-level data

Stefan Thurner, Tiziano Squartini, Diego Garlaschelli et al.

Supply chain network rewiring dynamics at the firm-level

Stefan Thurner, András Borsos, Tobias Reisch

No citations found for this paper.

Comments (0)