Summary

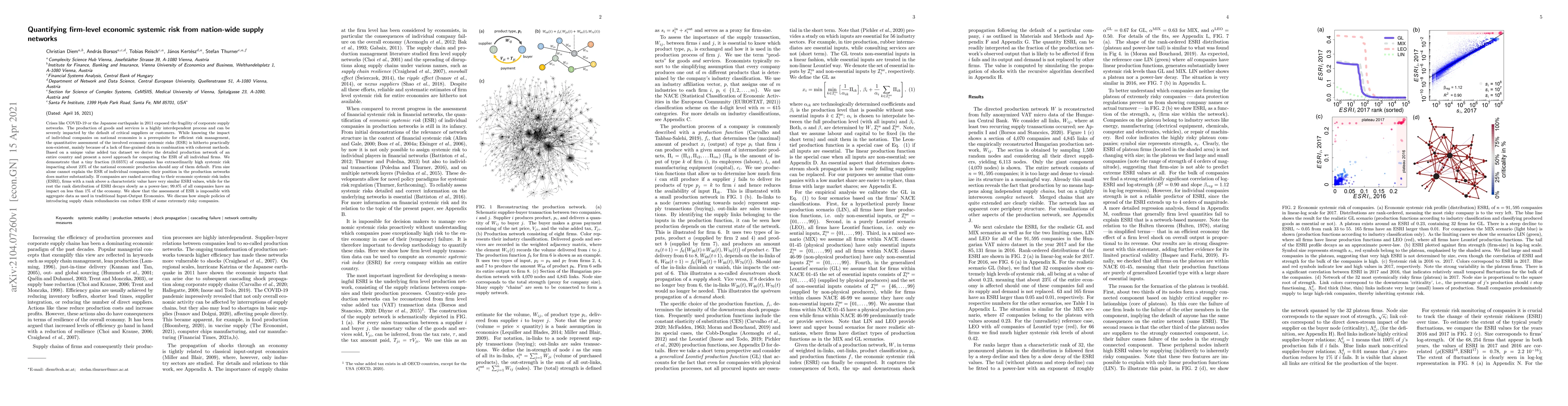

Crises like COVID-19 or the Japanese earthquake in 2011 exposed the fragility of corporate supply networks. The production of goods and services is a highly interdependent process and can be severely impacted by the default of critical suppliers or customers. While knowing the impact of individual companies on national economies is a prerequisite for efficient risk management, the quantitative assessment of the involved economic systemic risks (ESR) is hitherto practically non-existent, mainly because of a lack of fine-grained data in combination with coherent methods. Based on a unique value added tax dataset we derive the detailed production network of an entire country and present a novel approach for computing the ESR of all individual firms. We demonstrate that a tiny fraction (0.035%) of companies has extraordinarily high systemic risk impacting about 23% of the national economic production should any of them default. Firm size alone cannot explain the ESR of individual companies; their position in the production networks does matter substantially. If companies are ranked according to their economic systemic risk index (ESRI), firms with a rank above a characteristic value have very similar ESRI values, while for the rest the rank distribution of ESRI decays slowly as a power-law; 99.8% of all companies have an impact on less than 1% of the economy. We show that the assessment of ESR is impossible with aggregate data as used in traditional Input-Output Economics. We discuss how simple policies of introducing supply chain redundancies can reduce ESR of some extremely risky companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInferring firm-level supply chain networks with realistic systemic risk from industry sector-level data

Stefan Thurner, Tiziano Squartini, Diego Garlaschelli et al.

Evolution and determinants of firm-level systemic risk in local production networks

Giulio Cimini, Anna Mancini, Riccardo Di Clemente et al.

Combined climate stress testing of supply-chain networks and the financial system with nation-wide firm-level emission estimates

Stefan Thurner, Johannes Stangl, András Borsos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)