Summary

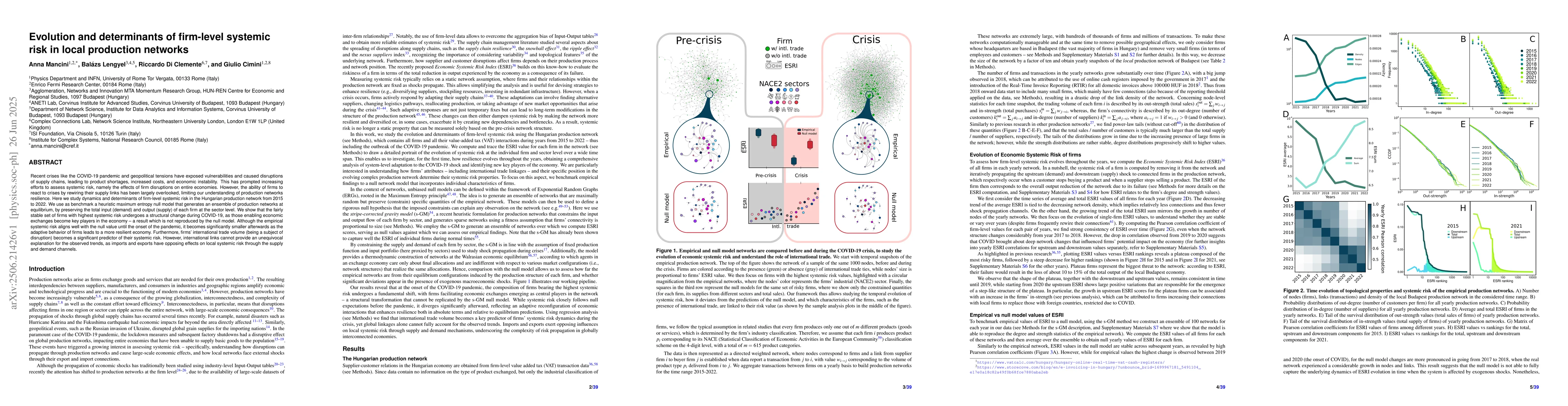

Recent crises like the COVID-19 pandemic and geopolitical tensions have exposed vulnerabilities and caused disruptions of supply chains, leading to product shortages, increased costs, and economic instability. This has prompted increasing efforts to assess systemic risk, namely the effects of firm disruptions on entire economies. However, the ability of firms to react to crises by rewiring their supply links has been largely overlooked, limiting our understanding of production networks resilience. Here we study dynamics and determinants of firm-level systemic risk in the Hungarian production network from 2015 to 2022. We use as benchmark a heuristic maximum entropy null model that generates an ensemble of production networks at equilibrium, by preserving the total input (demand) and output (supply) of each firm at the sector level. We show that the fairly stable set of firms with highest systemic risk undergoes a structural change during COVID-19, as those enabling economic exchanges become key players in the economy -- a result which is not reproduced by the null model. Although the empirical systemic risk aligns well with the null value until the onset of the pandemic, it becomes significantly smaller afterwards as the adaptive behavior of firms leads to a more resilient economy. Furthermore, firms' international trade volume (being a subject of disruption) becomes a significant predictor of their systemic risk. However, international links cannot provide an unequivocal explanation for the observed trends, as imports and exports have opposing effects on local systemic risk through the supply and demand channels.

AI Key Findings

Generated Jul 01, 2025

Methodology

The study analyzes firm-level systemic risk in the Hungarian production network from 2015 to 2022, using empirical data and a heuristic maximum entropy null model to generate an ensemble of networks that preserve sector-level input and output constraints.

Key Results

- The set of firms with the highest systemic risk remains fairly stable until the COVID-19 pandemic, after which structural changes occur, making firms enabling economic exchanges more central.

- Empirical systemic risk aligns with the null model until the pandemic, after which firms' adaptive behaviors lead to increased resilience and reduced systemic risk.

- International trade volume is a significant predictor of systemic risk, with imports and exports having opposing effects through supply and demand channels.

Significance

This research enhances understanding of how production networks respond to crises and the role of firm adaptability and international trade in systemic risk, informing policies for supply chain resilience.

Technical Contribution

The paper introduces a novel application of maximum entropy null models to analyze firm-level systemic risk and its evolution over time within production networks.

Novelty

It uniquely combines empirical data with null model comparisons to identify structural changes in systemic risk during crises, highlighting the importance of adaptive behaviors and international trade links.

Limitations

- The analysis is limited to the Hungarian production network and may not generalize to other countries or global contexts.

- The null model assumes sector-level constraints, which might oversimplify complex firm-specific behaviors and network dynamics.

Future Work

- Extend the analysis to other countries or global production networks to assess the universality of the findings.

- Incorporate firm-specific behavioral models to better understand rewiring strategies and resilience mechanisms.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInferring firm-level supply chain networks with realistic systemic risk from industry sector-level data

Stefan Thurner, Tiziano Squartini, Diego Garlaschelli et al.

Estimating the loss of economic predictability from aggregating firm-level production networks

János Kertész, Stefan Thurner, András Borsos et al.

Systemic risk mitigation in supply chains through network rewiring

Stefan Thurner, Leonardo Niccolò Ialongo, Giacomo Zelbi

No citations found for this paper.

Comments (0)