Summary

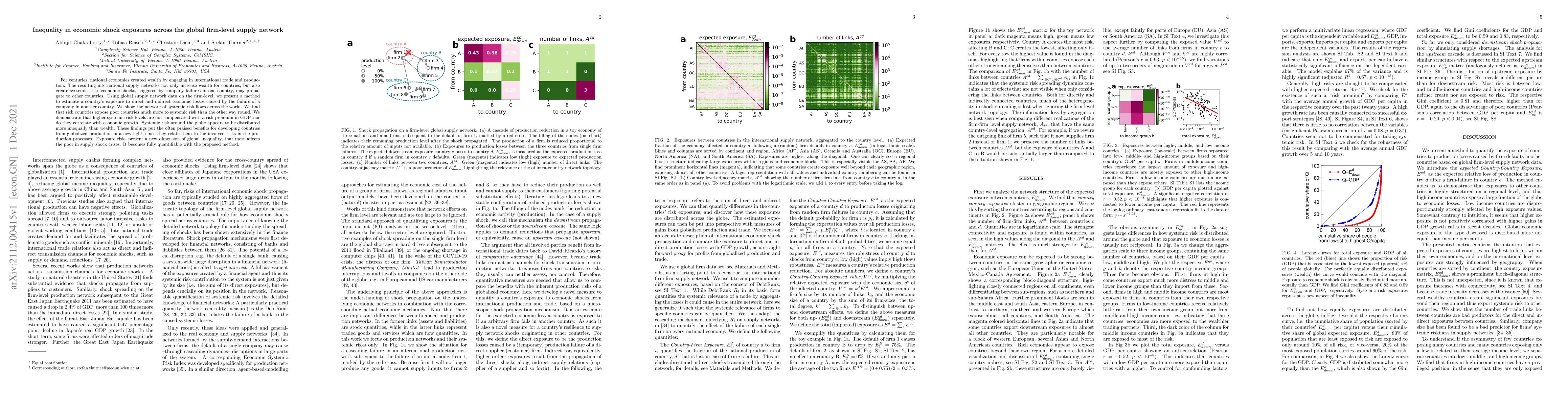

For centuries, national economies created wealth by engaging in international trade and production. The resulting international supply networks not only increase wealth for countries, but also create systemic risk: economic shocks, triggered by company failures in one country, may propagate to other countries. Using global supply network data on the firm-level, we present a method to estimate a country's exposure to direct and indirect economic losses caused by the failure of a company in another country. We show the network of systemic risk-flows across the world. We find that rich countries expose poor countries much more to systemic risk than the other way round. We demonstrate that higher systemic risk levels are not compensated with a risk premium in GDP, nor do they correlate with economic growth. Systemic risk around the globe appears to be distributed more unequally than wealth. These findings put the often praised benefits for developing countries from globalized production in a new light, since they relate them to the involved risks in the production processes. Exposure risks present a new dimension of global inequality, that most affects the poor in supply shock crises. It becomes fully quantifiable with the proposed method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSupply chain network rewiring dynamics at the firm-level

Stefan Thurner, András Borsos, Tobias Reisch

Firm-level supply chains to minimize unemployment and economic losses in rapid decarbonization scenarios

Stefan Thurner, Johannes Stangl, András Borsos et al.

Inferring firm-level supply chain networks with realistic systemic risk from industry sector-level data

Stefan Thurner, Tiziano Squartini, Diego Garlaschelli et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)