Summary

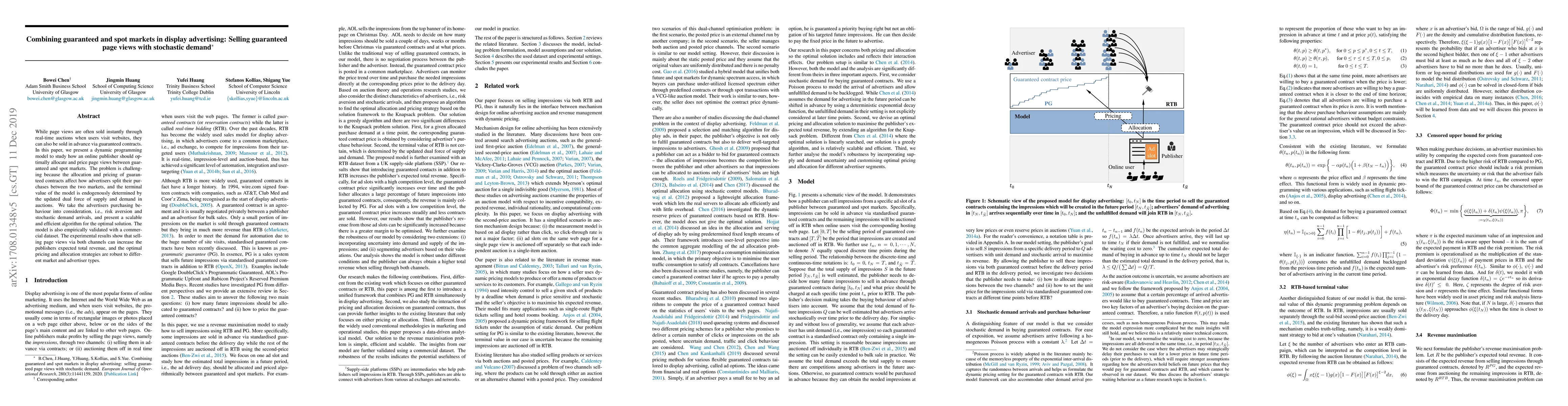

While page views are often sold instantly through real-time auctions when users visit websites, they can also be sold in advance via guaranteed contracts. In this paper, we present a dynamic programming model to study how an online publisher should optimally allocate and price page views between guaranteed and spot markets. The problem is challenging because the allocation and pricing of guaranteed contracts affect how advertisers split their purchases between the two markets, and the terminal value of the model is endogenously determined by the updated dual force of supply and demand in auctions. We take the advertisers' purchasing behaviour into consideration, i.e., risk aversion and stochastic demand arrivals, and present a scalable and efficient algorithm for the optimal solution. The model is also empirically validated with a commercial dataset. The experimental results show that selling page views via both channels can increase the publisher's expected total revenue, and the optimal pricing and allocation strategies are robust to different market and advertiser types.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPercentile Risk-Constrained Budget Pacing for Guaranteed Display Advertising in Online Optimization

Liang Wang, Bo Zheng, Guangming Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)