Summary

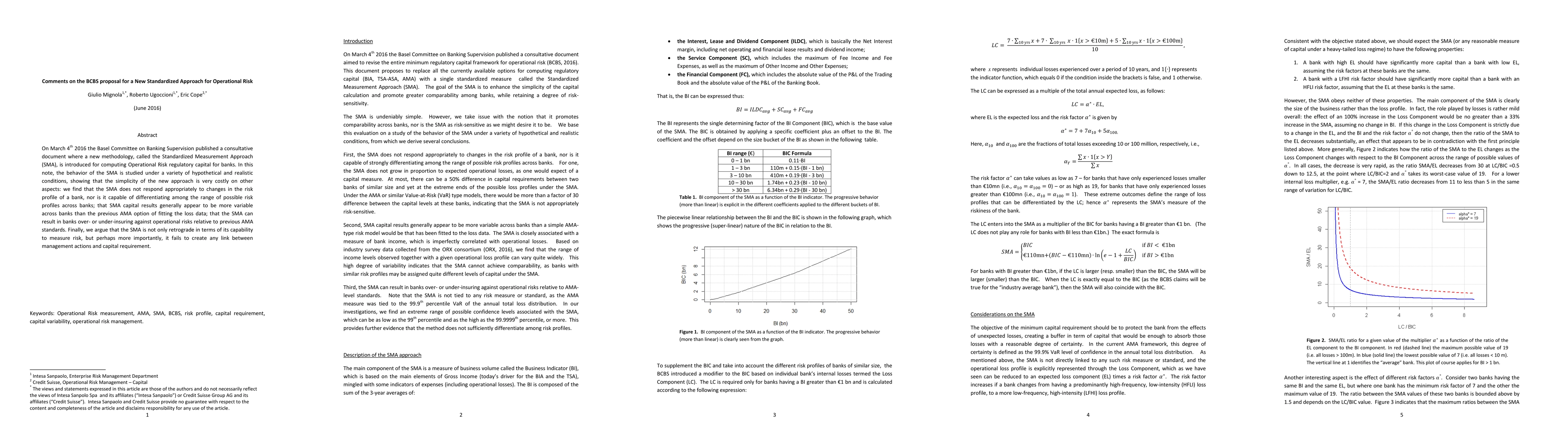

On March 4th 2016 the Basel Committee on Banking Supervision published a consultative document where a new methodology, called the Standardized Measurement Approach (SMA), is introduced for computing Operational Risk regulatory capital for banks. In this note, the behavior of the SMA is studied under a variety of hypothetical and realistic conditions, showing that the simplicity of the new approach is very costly on other aspects: we find that the SMA does not respond appropriately to changes in the risk profile of a bank, nor is it capable of differentiating among the range of possible risk profiles across banks; that SMA capital results generally appear to be more variable across banks than the previous AMA option of fitting the loss data; that the SMA can result in banks over- or under-insuring against operational risks relative to previous AMA standards. Finally, we argue that the SMA is not only retrograde in terms of its capability to measure risk, but perhaps more importantly, it fails to create any link between management actions and capital requirement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStandardized Measurement Approach (SMA) vs Advanced Measurement Approaches (AMA): A Critical Review of Approaches in Operational Risk

Omar Briceno Cruzado

A Proposal for Evaluating the Operational Risk for ChatBots based on Large Language Models

Fernando Gutierrez, Pedro Pinacho-Davidson, Pablo Zapata et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)