Summary

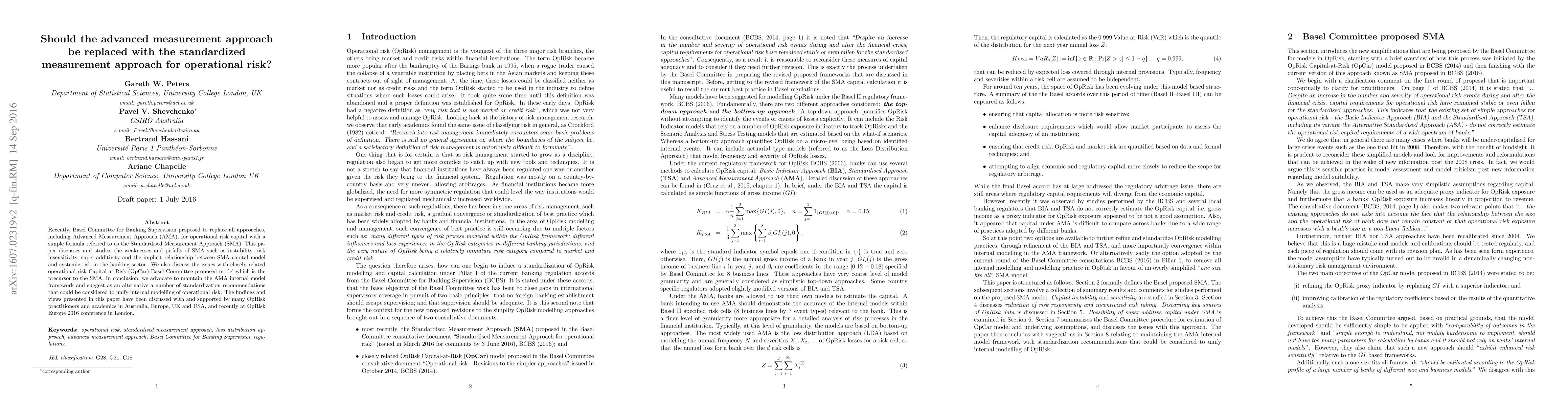

Recently, Basel Committee for Banking Supervision proposed to replace all approaches, including Advanced Measurement Approach (AMA), for operational risk capital with a simple formula referred to as the Standardised Measurement Approach (SMA). This paper discusses and studies the weaknesses and pitfalls of SMA such as instability, risk insensitivity, super-additivity and the implicit relationship between SMA capital model and systemic risk in the banking sector. We also discuss the issues with closely related operational risk Capital-at-Risk (OpCar) Basel Committee proposed model which is the precursor to the SMA. In conclusion, we advocate to maintain the AMA internal model framework and suggest as an alternative a number of standardization recommendations that could be considered to unify internal modelling of operational risk. The findings and views presented in this paper have been discussed with and supported by many OpRisk practitioners and academics in Australia, Europe, UK and USA, and recently at OpRisk Europe 2016 conference in London.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)